Outside School Hours Care

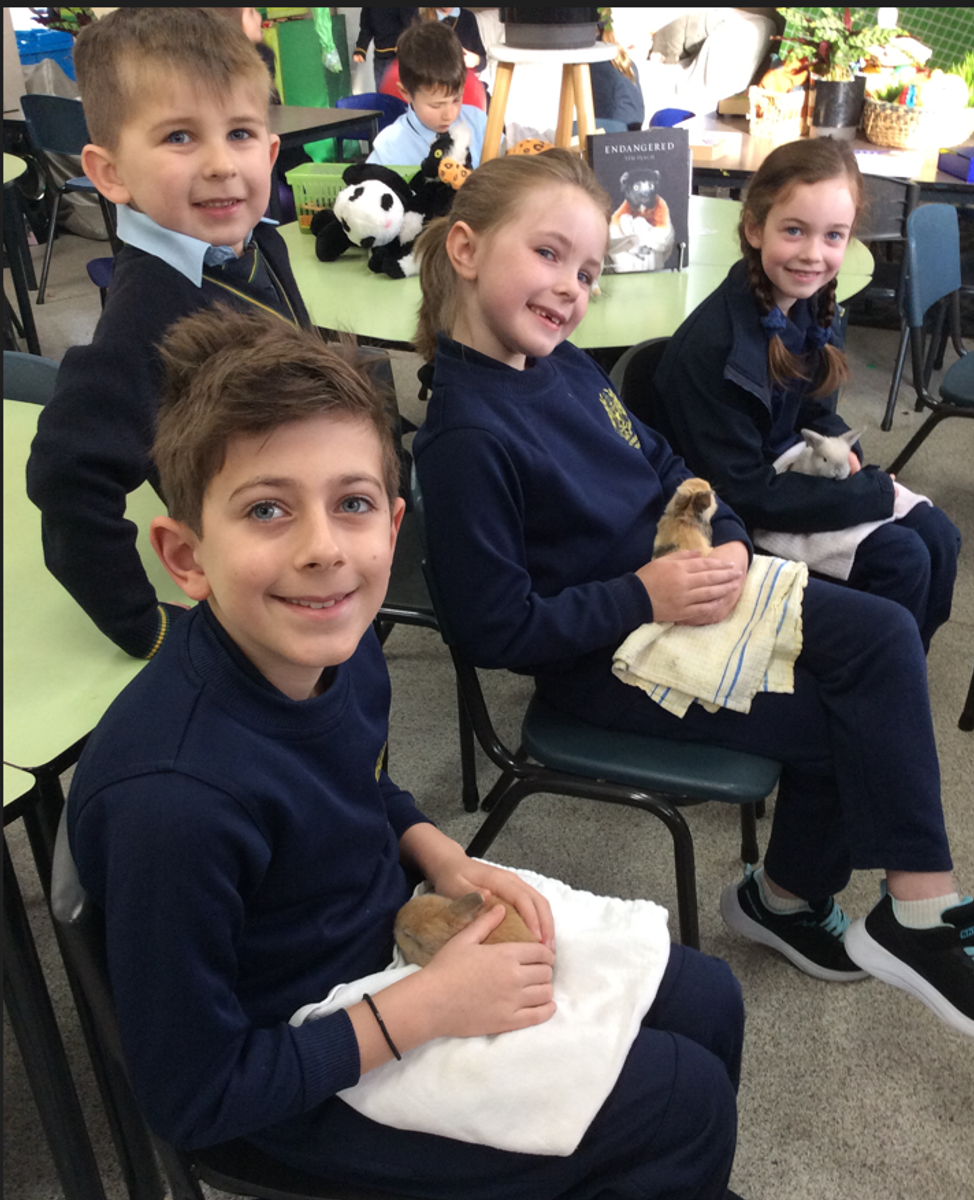

Rabbit Rearing Program: Two weeks on

When children observe, interact and care for an animal it can provide an enriching experience and be a valuable part in learning about empathy, relationships and nature. It also teaches children about responsibility and nurture. In partnership with the school’s Prep Pray night the kittens visited the classrooms with Sonia.

There are the creatures that surround us in the outdoors. In every natural setting there is an abundance of animal life that can deliver rewarding experiences for children. OSHC has several bird feeders, a bug hotel and a worm farm. We also encourage children to look and listen for evidence of animals every time we are outdoors.

Finally, a butterfly experience has been arranged for the upcoming Holiday Program. A gazebo will be set up to immerse children in the butterfly’s domain as they land on their hands, heads or shoulders. Children will be able to feed, admire, interact and learn about these amazing creatures.

Holiday Program:

The Holiday Program will be out next week. The dates are Sept 19th -30th with Friday 23rd CLOSED for the PUBLIC HOLIDAY. Please book and pay early to avoid disappointment.

Please note:

Fees $47 base rate per child per day.

All incursions, excursions and special activities are extra and ATTRACT CCS

$47 base rate + $30 incursion =$77 $77 x 50% rebate= $38.50 per day per child.

$47 base rate + $30 Incursion= $77 $77 x 85% rebate= $14.82 per child per day

Please ensure that CCS is up to date and that families are aware of their responsibilities for Balancing.

At the end of each financial year, Services Australia reconciles family payments, including CCS. This is to ensure families receive the correct amount of assistance for the year.

Families need to confirm their income after the end of the financial year for this to occur. This process is called balancing.

Families must confirm their income for the 2020-21 and 2019-20 financial years by 30 June this year to avoid losing CCS or incurring a debt.

Families confirm their income by:

· lodging their tax return, or

· telling Services Australia they don’t need to lodge a tax return. Families can complete an Advise non-lodgement of tax return using their Centrelink online account through myGov or through the Express Plus Centrelink mobile app. They’ll need to do this even if they’ve already told the Australian Taxation Office they don’t need to lodge.