Tax-Smart Strategies Before and After Retirement

By Melina Pisani

Tax-Smart Strategies Before and After Retirement

By Melina Pisani

Are you paying more tax than you need to?

I often meet Principals who are surprised by how much tax they could be saving, especially in the years leading up to retirement. With the right planning, you can make your money work harder and keep more of it in your pocket.

Here are three areas where smart tax strategies can make a real difference:

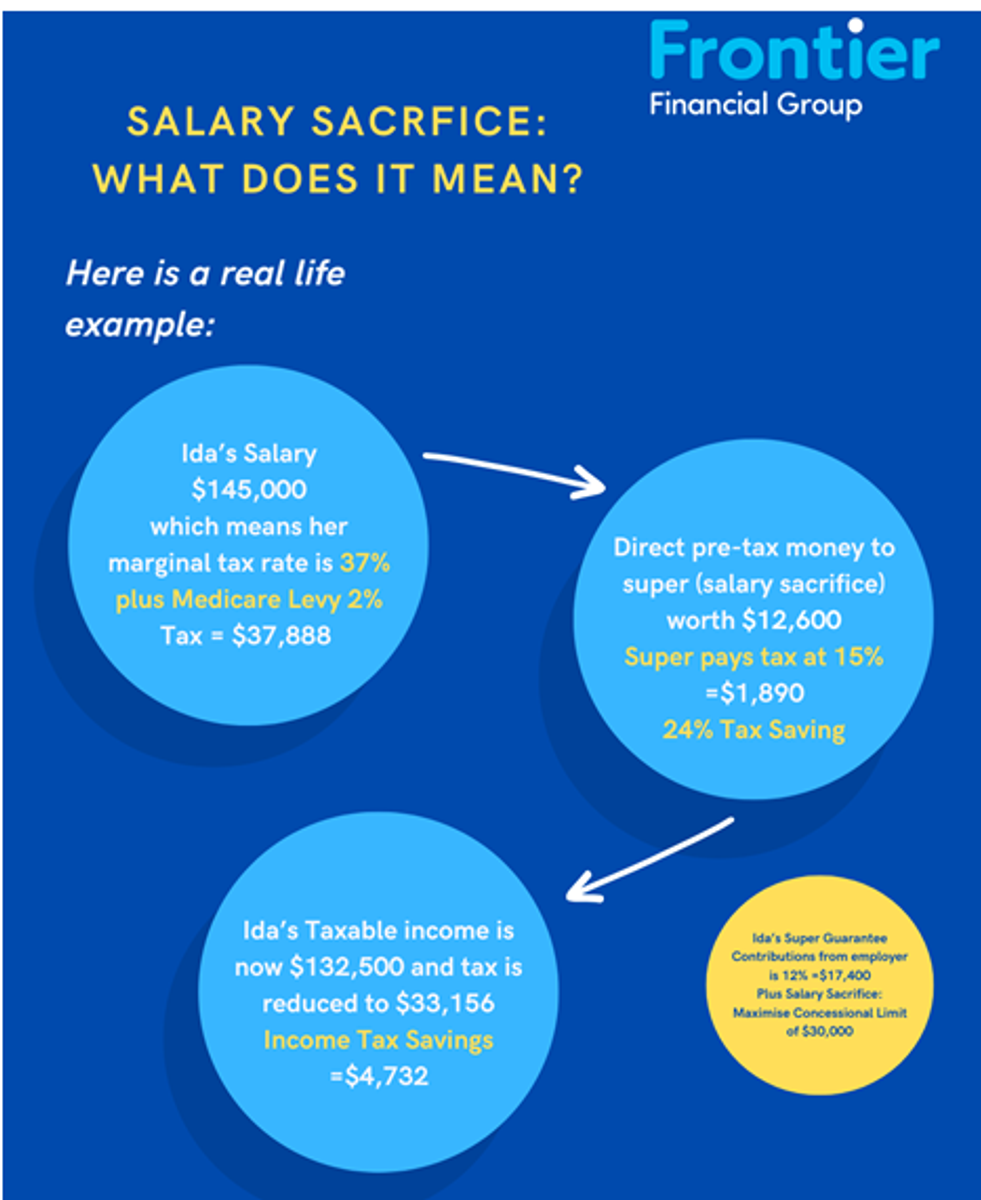

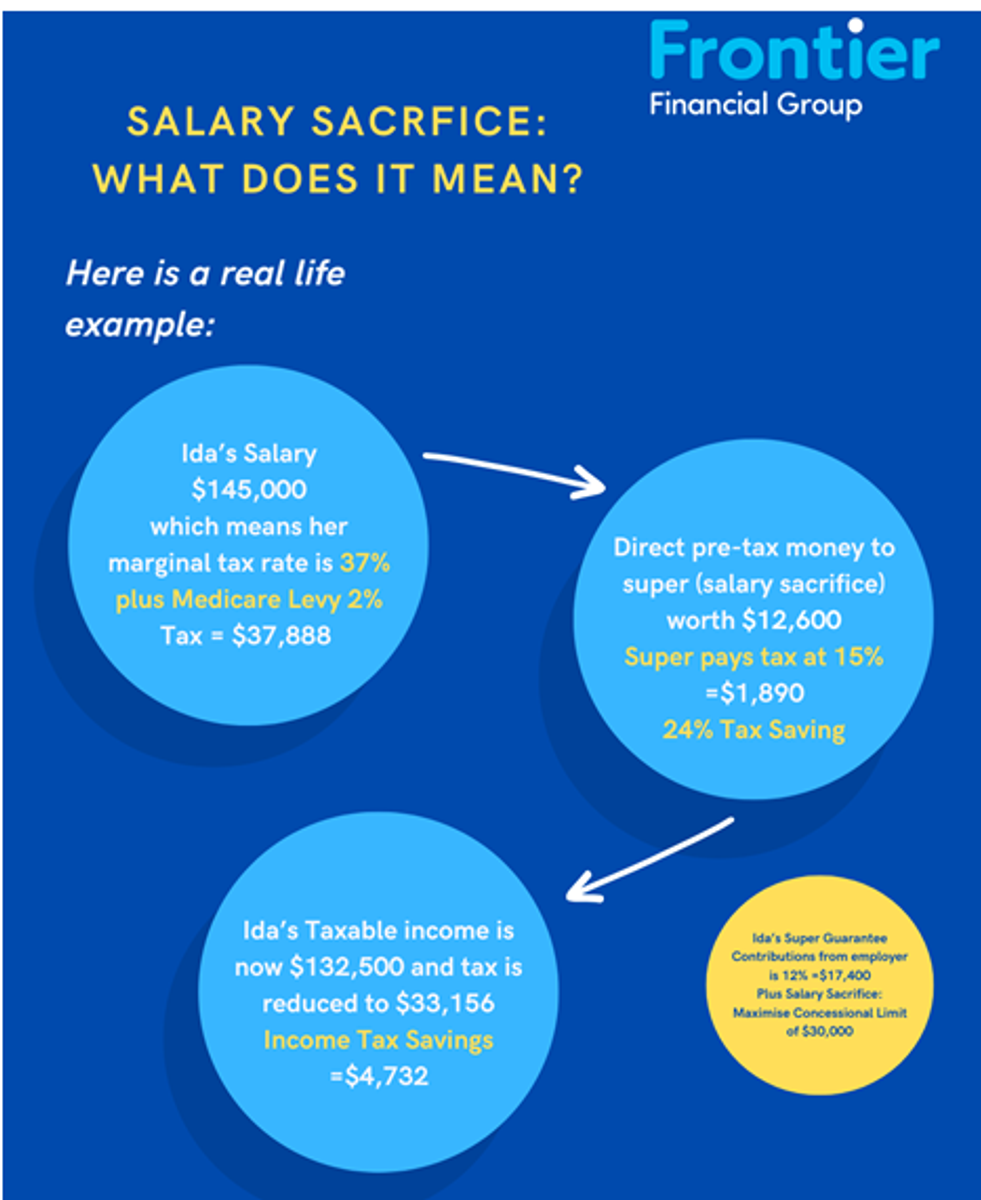

Super Contributions

Salary sacrifice and personal contributions can reduce your taxable income while boosting your retirement savings. Are you using the right mix?

Leave Entitlements

Redundancy and long service leave payouts can attract unnecessary tax if not managed carefully. Timing and structure matter, and I can help you get it right.

Retirement Income

Once retired, how you draw income from your super can affect how much tax you pay. A well-structured pension strategy can help you maximise income and minimise tax.

At Frontier, I work closely with school leaders to tailor strategies that suit your career and lifestyle. If you’re approaching retirement, now is the time to plan smart.

As a proud APF partner, I’m offering a complimentary strategy session to help you prepare with confidence.

Or contact me directly at melina@frontierfg.com.au or (03) 9671 4550