Network News

The latest from First National and across the industry

Network News

The latest from First National and across the industry

To make travel easier and more cost-effective, we’re hosting this year's Principals Retreat near the Auckland airport - so you can fly in and out on the same day if needed. This will be a fantastic opportunity to come together for a strategic and forward-thinking meeting, sharing ideas and setting the course for success. Your input is invaluable, and we truly appreciate the insights and experience you'll bring to the table.

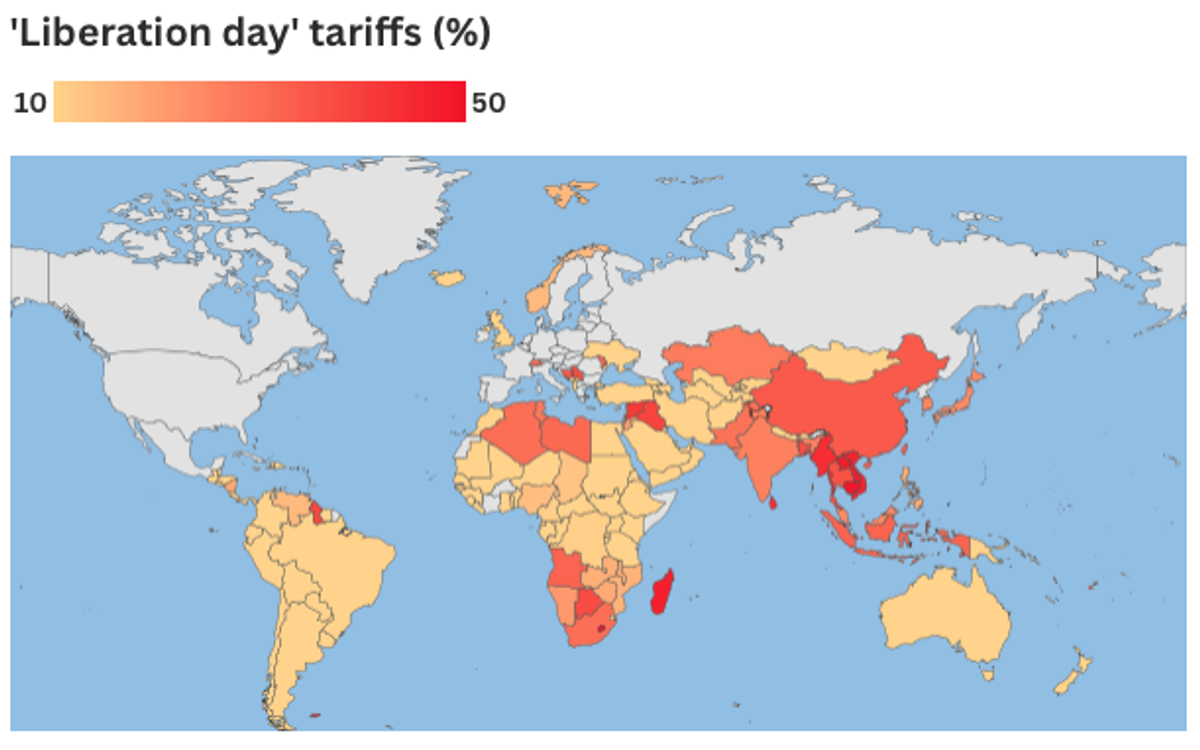

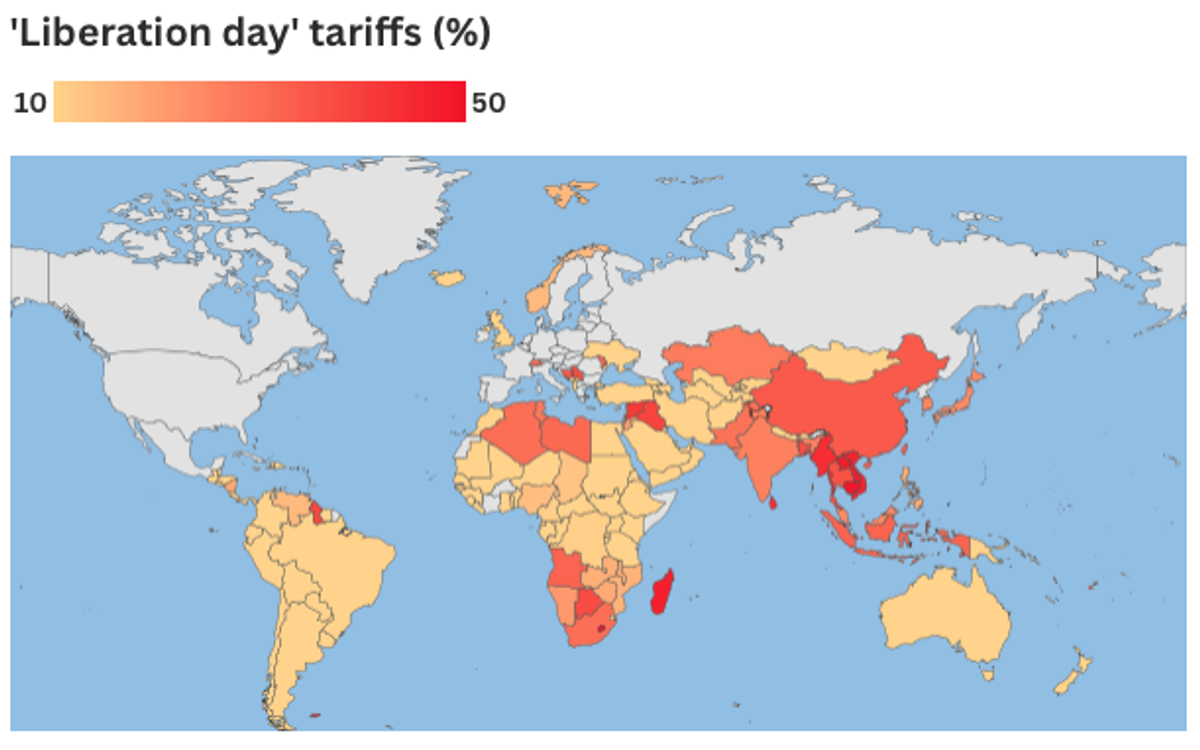

Although Trump's tariffs are a world away from Aotearoa, their consequences are rippling through our economy. The tariffs, which include a 10% baseline on all foreign imports to the US, are expected to dampen global demand, reduce export opportunities, and potentially destabilise currencies – including the New Zealand dollar.

New Zealand relies heavily on trade with both the US and China – two of the world’s largest economies currently engaged in tit-for-tat tariff escalations. With the value of US stocks taking a multi-trillion-dollar hit and investor confidence plummeting, our exporters and manufacturers are bracing for the flow-on effects. In the year ending March 2024, New Zealand exported approximately NZ$14.6 billion in goods and services to the United States, making the U.S. New Zealand's second-largest export market after China.

The RBNZ’s rate cut is intended to soften the blow. Lowering the OCR makes borrowing cheaper for businesses and households, and helps stimulate domestic spending and investment. This could be a crucial buffer if demand for New Zealand goods overseas drops.

Good News for Mortgage Holders?

There may be a silver lining for New Zealand homeowners. With the OCR now sitting at 3.50%, mortgage rates are likely to follow suit. Banks may begin passing on the cut in the form of lower home loan interest rates – a welcome relief for households still adjusting to the sharp post-COVID rise in the cost of borrowing.

“This move could ease the pain of the inflation-driven interest rate spike we saw following the pandemic,” says Lloyd Burr, Explainer Editor. “If the global economy slows more rapidly because of these tariffs, then rate cuts here could come faster than expected.”

Still Early Days

While the RBNZ has left the door open to further cuts, some economists remain cautious. Brad Olsen, CEO of Infometrics, believes it's too early for the full impact of the Trump tariff blitz to be baked into New Zealand’s monetary policy decisions.

“The MPC is aware of the risks, but they’re still gauging the extent and duration of this trade conflict,” Olsen explains. “The 25-basis point cut is a prudent response – but if global growth continues to weaken, we may well see more cuts in the coming months.”

What’s Next?

With U.S. tariffs now in effect, New Zealand is working with global partners to support free trade. Prime Minister Christopher Luxon is engaging with leaders from the EU and CPTPP to promote a rules-based system. The 10% U.S. tariff on NZ exports is expected to hold steady for now.

Markets remain volatile—despite a brief rally in U.S. stocks, uncertainty in global trade continues to impact NZ exporters. The RBNZ’s OCR cut reflects a cautious response to these pressures, with further moves possible depending on how the situation unfolds.