Department Financial Policy Changes

Information sent to schools via the School Bulletin on 15 December 2023, contained announcements relating to changes to some school financial policies. One could be forgiven for having missed or misinterpreted the changes given the timing of the announcement and limited information provided at the time.

There are three key changes that will impact on schools:

1. Changes to capital work threshold

This change makes it easier for schools to proceed with school-led capital works projects as the thresholds have been raised from $50 000 to $100 000 as from the start of 2024. This is a favourable change as the VSBA only needs to be engaged for projects over the increased threshold.

2. Deficit write-offs for small schools

Small schools that go into annual deficit as a result of expenditure on staffing salaries, will have an opportunity to have the deficit written-off by the Department up to $50,000.

(Note: small schools are defined as less than 80 students for primary schools and less than 400 students for secondary schools)

For this incentive to apply, small schools must be able to demonstrate that their deficit was caused by adding additional staff and the deficit is not offset by significant amounts of locally raised funds or funding received in cash that’s designed for staffing.

Schools will not be eligible for this incentive if they have submitted a credit to cash transfer within the calendar year.

Please contact the Schools Finance and Resources Branch for more information on the deficit write-off incentive by contacting them via email at schools.finance.support@education.vic.gov.au

3. School Credit Carryover Policy

This policy revision will impact upon schools who are expected to significantly underspend against their SRP credit allocation in 2024 as it limits the SRP credit funding that can be carried forward to the following year.

The amount of carryover allowed will be capped based on a proportion of the total credit component of the SRP NOT the surplus amount for the year (refer to examples below).

Rationale for this policy change is that there is a significant and growing, credit balance at a system level that is driven by the accumulation of SRP credit underspend. A school should be spending its SRP credit allocation on staff salaries for that year.

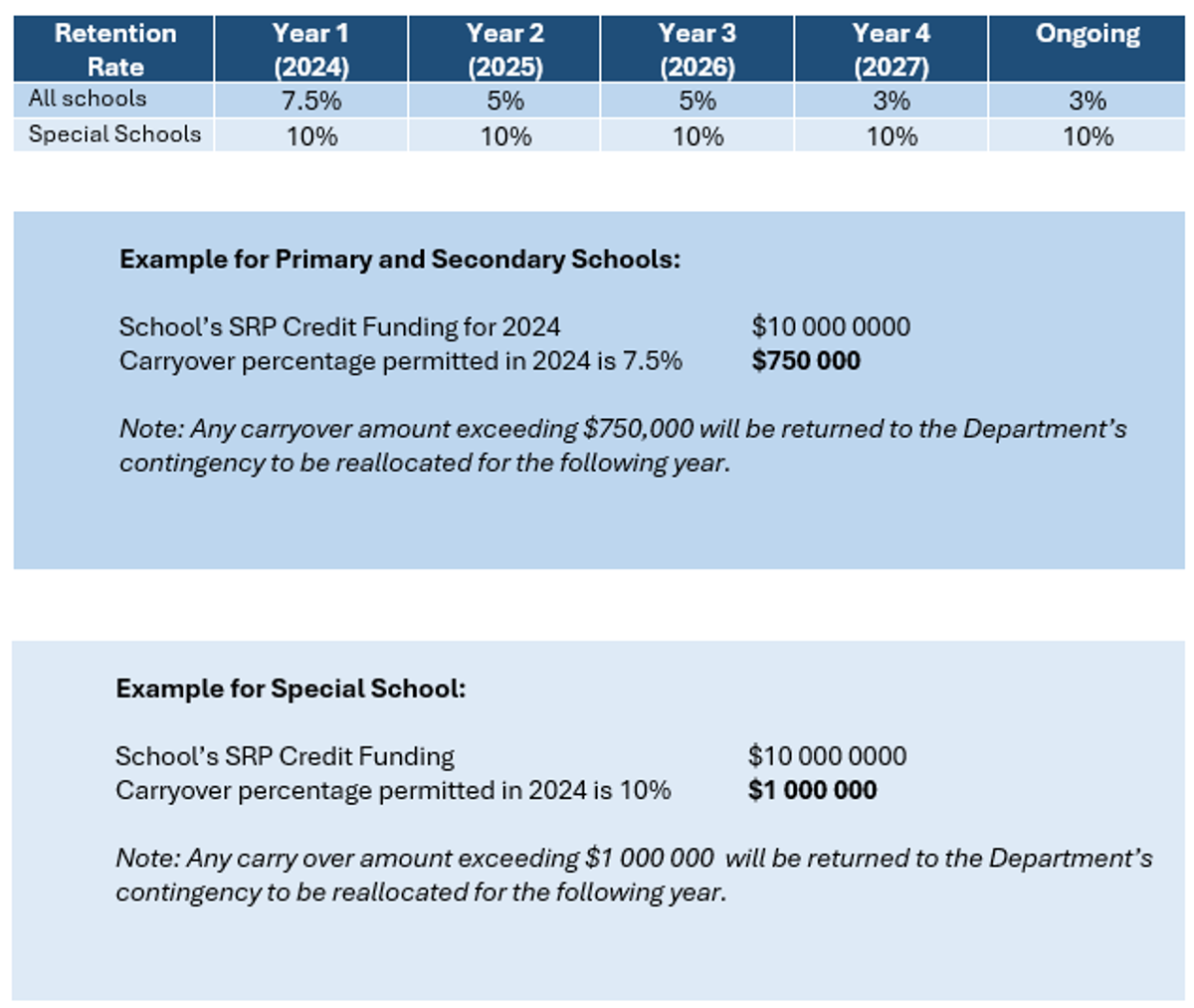

This policy change will be implemented over four years with a cap on carryover surplus based on percentage of total SRP credit budget as follows:

Points to note:

Schools will not have their surplus adjusted below $100 000 or $200 000 for special schools. This is to protect small schools who may otherwise be disproportionately impacted by a percentage-based model.

Treatment of accumulated funds up until 2023

All unspent surplus credit funds that have been accumulated up until 2023 will be separated or ‘ring fenced’ in their entirety. Schools will have the entire transition period (four years) to spend the balance, and anything remaining after the transition period will be redirected to the department’s central contingency.

Full information about the policy changes is available at the following sites and we encourage our members to fully familiarise themselves with these policy changes: