Agency Practice

The seismic shock about to hit real estate

👓 3.2 minute read

If we told you there was once-in-a-career shift coming that could bankrupt your business, you wouldn't ignore it would you? Well be assured, it is coming and it's time to pay attention.

July 2026 may seem a long way off right now but AML/CTF Tranche 2 legislation will change everything to do with listing and selling property. It won't just be something managed by your receptionist, it will completely change every sales agent's daily practices and introduce new senior management level responsibilities.

Think of it like the internet and social media arriving on the same day.

What are the likely changes to daily agency practice?

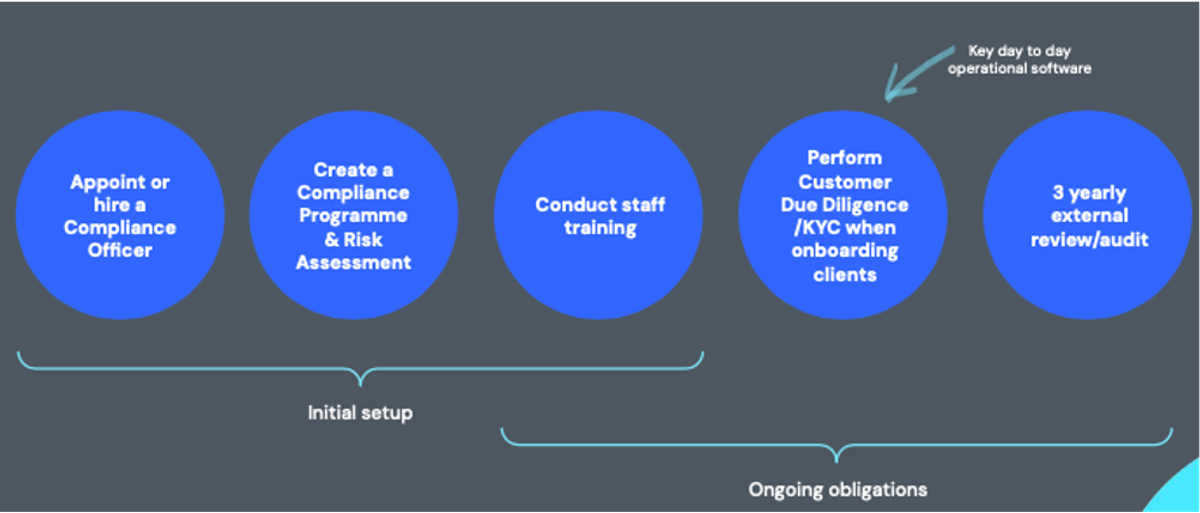

- Vendors and purchasers in Australia will be required to prove who they are (drivers licenses and passports) as well as potentially be required to explain the origins of their wealth

- Sales agents will be responsible for performing Customer Due Diligence (CDD) and Know Your Customer (KYC) checks - before any work can start

- Each agency will need to appoint a Compliance Officer (CO) - the legislation specifies this is a senior management position, not a junior role

- The law will require suspicious transactions to be reported

- Staff will require ongoing training and awareness checks

- Records will need to be kept for an audit every three years (costing approx. $1,500)

What was New Zealand’s experience during implementation?

In New Zealand, real estate agencies who appointed juniors and receptionists to the role of Compliance Officer found this was a gigantic mistake when they experienced their first 3-year audit. In many cases, substantial costs were incurred as agencies were required to backtrack and repeat/strengthen CDD/KYC measures. This is why the initial risk assessment document that will guide your agency will be crucial.

Agents also found that they needed additional skills and training to manage the sensitivities of gathering information their clients considered was none of their business – especially when it came to source of wealth information. Principals also found that the appropriate personality for Compliance Officers was that of a pragmatic teacher, rather than a police officer. An ability to take a serious but practical approach to risk is integral to overall harmony in the office environment.

Consequently, a significant amount of preparatory and ongoing training will be needed for all team members.

What is the pathway to compliance?

Real estate agents will be at the front end of CDD/KYC and will need to be equipped to handle the process with sensitivity, practicality and adherence to Australian Privacy Principles. Each agency will be required to write an individual risk assessment, then continue to adapt that ‘living document’ on an ongoing basis.

June 2025 - AML/CTF rules finalised

August 2025 - AUSTRAC core guidance released

March 2026 - Enrol with AUSTRAC

June 2026 - Compliance deadline

What are the penalties for non-compliance?

In New Zealand, where real estate agents have been responsible for AML due diligence for six years, there are substantial fines for non-compliance:

Compliance Officers - $250,000

Companies - $2,500,000

There are also very strict ‘Tipping Off’ laws that agents will need to be aware of. Although not yet applicable to real estate agents in Australia, AUSTRAC has just strengthened its tipping off penalties. Any person or business submitting a Suspicious Matter Report (SMR) who then infers that a report has been submitted to tip off a criminal may face a two year prison term.

Why do we need anti money laundering measures?

👓 1.5 minute read

Money laundering is not just a concern for banks or financial institutions—it has long been a major issue in real estate. Criminals exploit property transactions to disguise illicit funds, often inflating property prices, distorting competition and introducing hidden financial risks into the market.

Australian federal police say the Australian property market, given its value growth and liquidity, has become an 'attractive destination for criminals to both store value and enjoy the fruits of their illicit activities'.

AFP data shows real estate is by far the biggest asset type seized by its criminal assets confiscation taskforce. The AFP restrained about 78 properties worth $106.6m in 2021-22, with an average property value of $1.36m. That doubled the following year, when $220.4m in property was restrained, with an average estimated value of $2.34m a property.

What next?

First National Real Estate is assessing available options to support your business. Fortunately, there are robust and mature technology solutions available to the industry that will facilitate your transition to a compliant ‘reporting entity’.

In the meantime, please do not commit to any providers that may approach you. There are a great number of Anti Money Laundering companies who have developed expertise within the banking and legal communities (Tranche 1) however very few are experienced with the nuances of real estate (Tranche 2).

NSW Residential Tenancies Amendment Regulation 2025

👓 1 minute read

This New South Wales regulation, effective shortly after the commencement of the Residential Tenancies Amendment Act 2024, modifies the existing Residential Tenancies Regulation 2019.

The amendments clarify grounds for landlords refusing pets, specify required documentation for termination notices, and mandate the provision of certain information to the Secretary.

Furthermore, the regulation exempts social housing and purpose-built student accommodation from specific Act provisions and sets time limits for Tribunal applications.

Finally, it increases a maximum monetary penalty and updates the standard residential tenancy agreement form while also designating certain offences as penalty notice offences.

Grab a copy of the regulations now.

Listen to our AI hosted deep dive discussing the regulations