Network & Industry

In This Edition…

🍊 Trump tariffs to force RBA to cut rates up to four times in 2025

📜 NSW, Victoria and Tasmania State Award winners

⚡ The seismic shock about to hit real estate

🤖 Surge in AI uptake across Australian agencies

🏡 Budget heralds limited change for housing

✍🏻 Best practices in AI prompt engineering for ad copywriting

🏍️ Wodonga's rising star Jackson Rice gears up for breakout year in motorsport

💭 Unlocking more creativity with Generative AI

⌛ Save 60% of the time spent dealing with maintenance

First National’s top performers and rising stars honoured

👓 1 minute read

New South Wales and Victoria/Tasmania have celebrated their successes of 2024 at our recent State Awards evenings, with events hosted at Doltone House Darling Island (NSW) and the National Gallery of Victoria (Vic/Tas).

In Sydney, FN Byron Bay was announced winner of NSW Sales Office of the Year and FN Hills Direct (The Ponds) was announced NSW Property Management Office of the Year.

Topping the individual awards were:

- Rebecca Lewis of FN Patterson (Port Macquarie) who took home NSW Property Manager of the Year

- Tanmay Goswami of FN Neptune (Bella Vista) who won NSW Business Development Manager of the Year

- Su Reynolds of FN Byron Bay who achieved NSW Salesperson of the Year.

In Melbourne, FN Charles L. King & Co (Echuca) was announced winner of Vic/Tas Sales Office of the Year and FN Hall & Partners (Dandenong) was announced Vic/Tas Property Management Office of the Year.

Topping the individual awards were:

- Jackie Lyons, FN Hall & Partners (Dandenong) who took home Vic/Tas Property Manager of the Year

- Suzy Candappa, FN Candappa (Drouin) who won Vic/Tas Business Development Manager of the Year

- Troy O'Brien, FN Charles L. King & Co (Echuca) who achieved Vic/Tas Salesperson of the Year

Congratulations to all our award winners. You’re now in the running for our National Awards at our Port Douglas Convention this May, and we can’t wait to see you there!

The seismic shock about to hit real estate

👓 30 second read

Imagine that we told you that adjusting your business practices to Anti Money Laundering (AML) and Counter Terrorism Financing (CTF) would be like having to grapple with the internet and social media arriving on the same day. Well, it's going to be a bit like that!

July 2026 may seem a long way off right now but AML/CTF Tranche 2 legislation will change everything to do with listing and selling property.

It won't just be something managed by your receptionist, it will completely change every sales agent's daily practices and introduce senior management level responsibilities.

Read our briefing in Agency Practice for an update on what’s coming.

Are you joining us at Convention?

👓 2 minute video

For more information and to register, visit www.fnconvention.com.au

Budget heralds limited change for housing

👓 1.5 minute read

With the Government having announced its Budget, we will see an expansion of the 'Help to Buy' scheme through a lift to price caps and income eligibility.

Under Labor's shared equity scheme, the commonwealth provides first home buyers with 30% of the purchase price of an existing home, or 40% for a new home. The first home buyer needs to contribute at least a 2% deposit. The scheme is capped at 10,000 places a year, with a total of 40,000 places over four years.

Income caps will be increased from $90,000 to $100,000 for single applicants, and from $120,000 to $160,000 for joint applicants and single parents.

Property price caps will also be increased in line with the average house price in each state and territory:

- Brisbane price caps will lift from $700,000 to $1m (rest of QLD lifts from $550K to $700K)

- Melbourne from $850,000 to $950,000 (rest of VIC stays at $650)

- Sydney from $950,000 to $1.3m (rest of NSW lifts from $750K to $800K)

- Perth from $600,000 to $850,000 (rest of WA lifts from $450K to $600K)

- Adelaide from $600,000 to $900,000 (rest of SA lifts from $450K to $500K)

- Hobart from $600,000 to $700,000 (rest of TAS lifts from $450K to $550K)

- Northern Territory stays at $600,000

In its Budget reply, the Coalition said that, if elected, it will cut the Housing Australia Future Fund (HAFF), let first homebuyers access up to $50,000 of their superannuation, cut immigration by 25%, reduce APRA’s serviceability buffer from 3% to 2.5% (allowing more people to borrow) and deploy an infrastructure package aimed at delivering 500,000 new homes.

More announcements are anticipated during the election campaign.

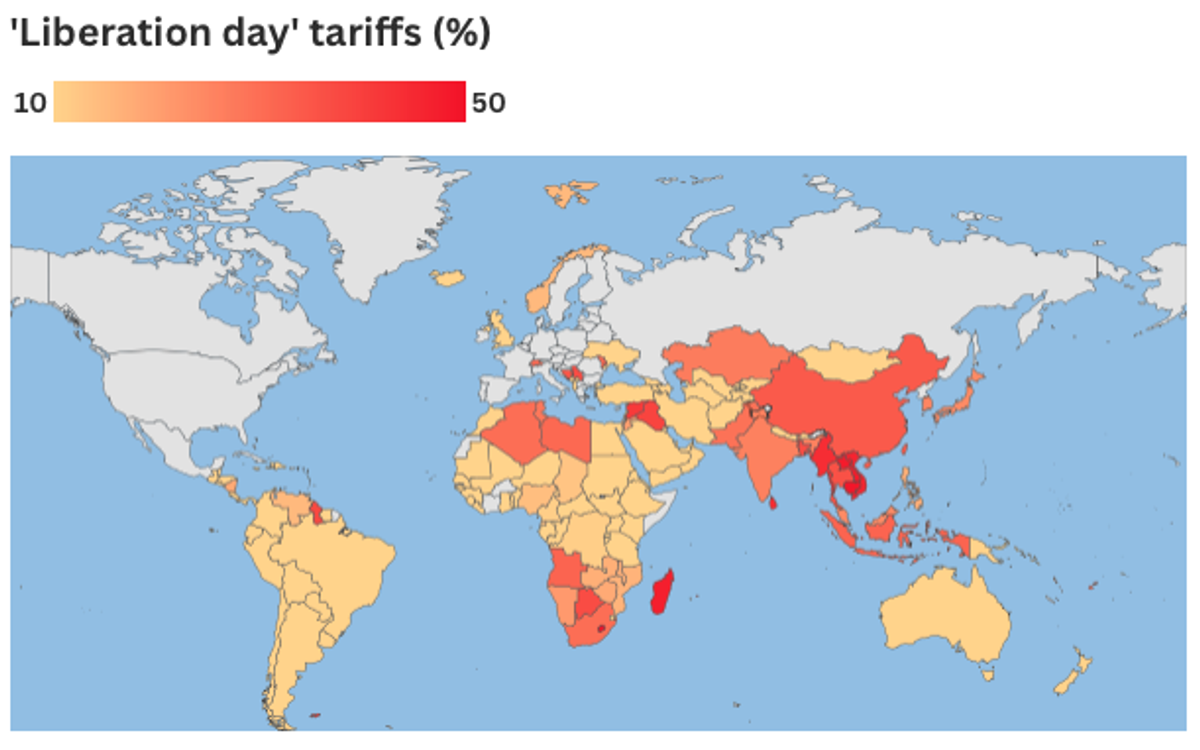

Trump tariffs to force RBA to cut rates up to four times in 2025

👓 45 second read

Markets are increasingly confident the Reserve Bank of Australia will cut the cash rate in May and up to another three times after that, as economists predict US President Donald Trump’s tariffs will cause a global slowdown that will spill over to the Australian economy.

With America accounting for just 4 per cent of Australia’s goods exports, economists said the direct effect of Trump’s 10 per cent tariff on Australia would be modest.

But they warned the broader risk to the Australian economy was significant, with Australia’s major trading partners including China, Japan and South Korea hit with new tariffs ranging from 24% to 34%.

AMP chief economist Shane Oliver says the tariffs are worse than markets expected. For Australia, the new trade barriers are more likely to cause growth to slow than for inflation to rise, adding to the case for more RBA interest rate cuts.

Professional development opportunities

NSW

What: Business Leadership Session

When: 9 April 9:30 am to 1:30 pm

Where: Ballina RSL Club

Register: Click here

What: Property Management Think Tank

When: 10 April 10:00 to 1:00 pm

Where: Surf Club Coffs Harbour

Register: Click here

What: Property Management Training with Julie Collins

When: 10 April 9:30 am to 1:30 pm

Where: Ballina RSL Club

Register: Click here

What:

Michael Sleiman Auction Training

Chris Booth | Eliminate Funding Friction in the Sales Process

When: 1 May 9:30 am to 12:30 pm

Where: Club Parramatta, Sydney

Register: Click here

QLD

What: QLD Sales Power Up

When: 10 April 10:00 am to 4:00 pm

Where: Rydges South Bank Brisbane

Register: Click here