Network & Industry

In This Edition…

💬 The Hostage Negotiator’s Tactic Agents Don’t Talk About (Agency Practice)

👩🏽💼 Trademark Attorneys Target First National Agencies (Network & Industry)

📈 BGMs set their 2025 Support Agenda (Network and Industry)

🏡 Open Home Negligence Costs Agency $1.5m (Network and Industry)

🐾 Clarity At Last on Pets & Modifications for WA property managers (Agency Practice)

🛡️ Improve The Safety of Your Data When Using ChatGPT (AI & Technology)

👩🏻❤️👨🏻 The First National Power Couple Making Real Estate Work (Media & Marketing)

FN’s 2025 Support & Growth Agenda Launched

CEO outlines 2025 strategy to membership support team

Newly inducted team members introduce themselves

Learning & Development Review outlined

David Edwards welcomed the network’s member support team to National Support Office (NSO) last week to set the course for 2025 growth, and to explain plans and projects in development.

Darren Pearce (Membership Director), Mark Jansen (Communications & Marketing Director) and Betty Ninas (Network Growth Manager) each took the opportunity to introduce themselves and talk a little about their backgrounds and experience.

Melinda Blake of HR Advice Online hosted a pivotal workshop with BGMs concerning the evolution of their position description, which now incorporates an overall co-responsibility with the management team for network growth.

Suzi Cowperthwaite (Member Services Manager) outlined progress being made with the network’s learning & development review, and how this will positively impact members’ teams. Finally, Robin Johnston (Chief Financial Officer) outlined his analysis of First National’s value proposition.

Discussion and planning for the network’s fast-approaching Port Douglas National Convention were enhanced by an Alliance Partners breakfast meet and greet, before the BGMs engaged in a training session on First National’s toolkit of resources.

We would like to thank all of our Alliance Partners in attendance: Excel, Affordable Staff, CoreLogic, REA, Printforce, Propps, REISuper, Officeworks, Tapi, Zenu, and HR Advice Online.

Which Suburbs Will Do Best When Rates Are Cut?

Today Australians will learn whether the Reserve Bank will cut the Official Cash Rate (OCR) for the first time since November 2020. A majority of economists seem to think there’s reason for optimism, so which suburbs will do best when the first rate cut comes?

According to CoreLogic, analysis of previous rate reduction periods points to an increase of values by an average of 6.1% for each 1 percentage point rate cut. Across the nation, the suburbs that have historically experienced the highest gains after a 1% OCR drop are:

Sydney – Leichardt (19.1%), Sutherland, Menai, Heathcote (19%), Warringah (18.1%), Dural, Wisemans Ferry (17.7%)

Melbourne - Whitehorse West (18.4%), Essendon (18%), units in Glen Eira (12.3%)

Brisbane – Historically has reacted strongly to rate cuts but is now much more expensive so difficult to predict

Adelaide - Port Adelaide West ( 5.1%), Gawler & Two Wells ( 3.3%)

Perth - Bayswater & Bassendean houses (3.1%) and units (5.6%)

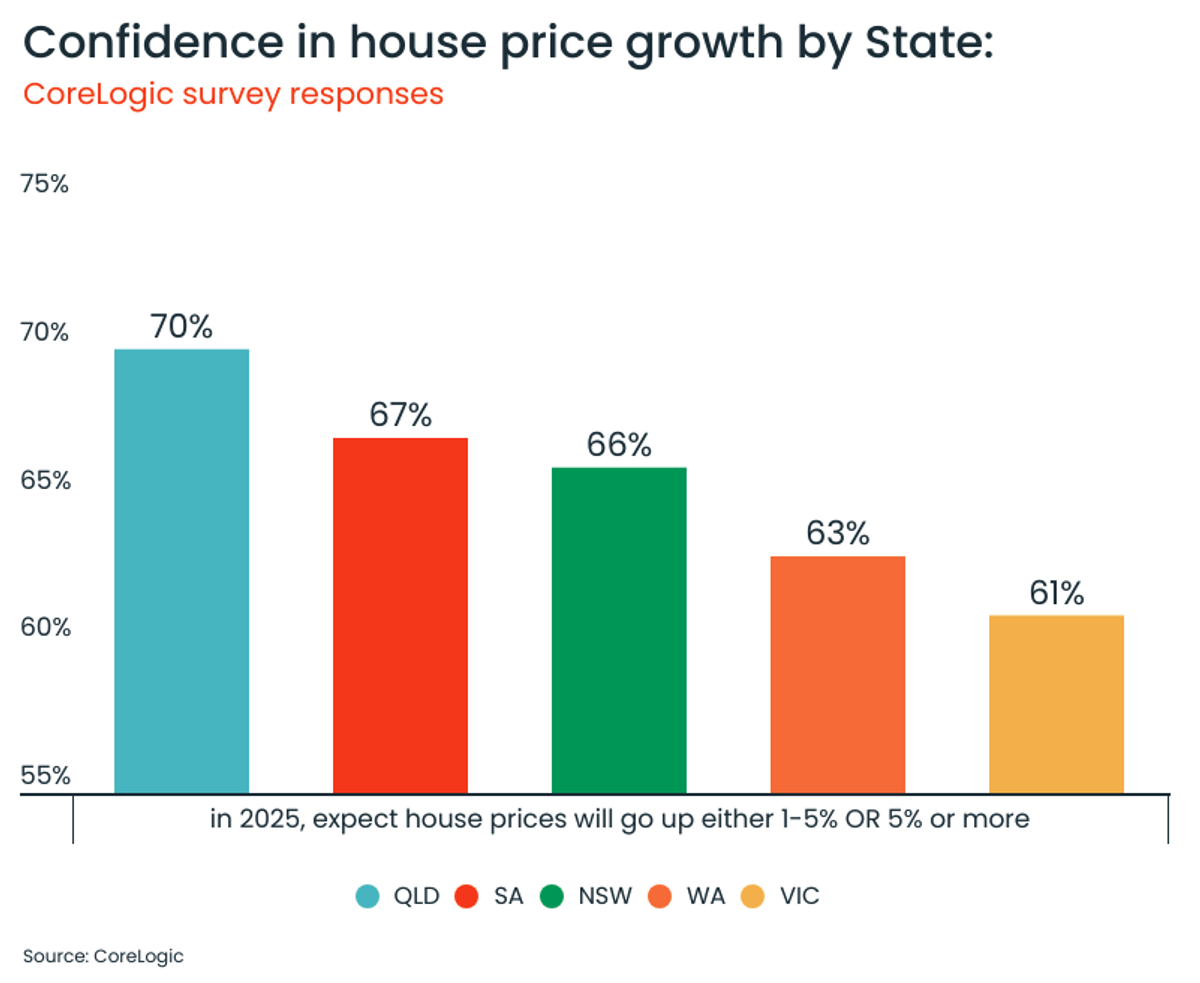

A CoreLogic survey of consumer expectations concerning likely rises in house prices also provides an indication as to the strength of buyer sentiment across the country. Plus, we know auction clearance rates are at their highest since October 2024, so the market is buoyant.

Overall, the markets that stand to gain the most from a rate cut are those that have demonstrated the most sensitivity in the past. These are typically considered to be higher end Sydney and Melbourne properties that have fallen the most during rising rates.

‘Trademark Attorneys’ Target FN Agencies

Several First National offices have reported emails from companies posing as trademark attorneys or domain registry agents. These quite convincing emails are fraudulent; please do not engage with the senders.

In each case, the approach email takes the form of a polite notification informing the First National principal that an application has been received from somebody for your company’s existing trading name, or your company’s website domain address (in another jurisdiction).

Should you receive such an email, please don’t reply or engage in discussion with the sender. Forward the email to communications@firstnational.com.au or your Business Growth Manager for advice.

Open Home Negligence Costs Agency $1.5m

The homes we sell can have multiple slip and fall hazard risks

Examples include steep pathways, slippery pool tiles, stone floors, mossy pathways

A judge has ruled that assessing, managing and warning of these risks is OUR responsibility

An agency that failed to warn buyers about a steep and slippery driveway has been slammed with a $1.5 million damages order. The judgement serves to highlight the critical value of your agency’s professional indemnity insurance.

In the days leading up to the first open home, the vendor re-painted the driveway (to cover rust marks) and on the morning of the first open home, a light shower made the driveway ‘dangerously slippery’. A prospective purchaser slipped and fell heavily on the driveway, as did the real estate agent when going to help her. The purchaser suffered injuries to her neck, shoulders, right hip and knee, leading to ongoing debilitating pain.

Despite the vendor initially denying having painted the driveway, a judge ruled that the homeowner and agency were guilty of negligence for failing to exercise reasonable care, therefore breaching their duty of care to customers. The particulars of negligence included:

Failing to warn of the risk of slipping on the driveway

Failing to conduct an adequate risk assessment of the slipperiness of the driveway when wet

Failing to place non-slip mats over the driveway prior to the inspection

The learning for all estate agencies is that sales agents have a duty of care to take precautions against the risk of harm at open home inspections. In this instance, the agent could have directed people away from the driveway and asked that they use the stairs to the front door.

First National recommends principals double check their professional indemnity insurance is current, brief property managers and sales agents concerning vigilance for slip and fall risks, and regularly remind staff of their duty of care.

Honan Insurance is First National Real Estate’s long-trusted Alliance Partner for PI Insurance. Australia-wide contacts are available on FN Central.

Tailored Information Session: New NSW Rental Laws

NSW Fair Trading is offering a specially tailored training session for property managers to better understand new NSW rental laws. The session will provide the opportunity to ask questions directly of Fair Trading so you can better understand rights and responsibilities.

NSW BGMs Sarah Barton and Amy Bruce have also compiled a guideline explaining the changes to NSW Landlords, which can be downloaded here.

Property Managers Open Up About Their Challenges

First National’s 2025 Training & Events Calendar kicked off with Property Management Think Tanks in Parramatta and Wollongong. At both sessions, our property managers opened up about their challenges, ideas for growth, and questions related to new rental laws. Key takeaways were:

Charging for inspections and increasing management or ancillary fees

Update and review breach processes

Exploring AI tools

The importance of landlord insurance

‘Just want to say I absolutely loved the open format of this event. The open discussion style was great, very engaging and made me feel comfortable raising topics I may not have otherwise.’

Lachlan McDougall

FN Penrith

‘It was great to be part of the network and connect with fellow colleagues at the recent Property Management Think Tank. Sarah did an excellent job setting the flow of the day, ensuring everything ran smoothly. It was a fantastic opportunity to engage in insightful conversations and leverage collective knowledge to further enhance our expertise in the field. Looking forward to the next one.’

Fiona Ivanusa

FN Pinnacle (Campbelltown, NSW)

A fabulous day, it was wonderful to have a round table discussion with my peers and chat about upcoming changes in legislation and how it will impact on our roles.

Tricia Murdoch

FN Coast & Country (Gerringong, NSW)

Register For Your State Awards Celebration

Time is running out to get you and your team registered for our upcoming 2025 State Awards nights. Register today and we’ll see you there!

Register for WA – Friday 21 February, Crown Perth

Register for SA/NT – Friday 28 February, The National Wine Centre

Register for QLD – Saturday 8 March, The Star Brisbane

Register for NSW – Saturday 22 March, Doltone House, Jones Bay Wharf

Register for VIC/TAS – Saturday 29 March at the National Gallery of Victoria

Property Managers: $50 For Your Perspective On Terminations

The Australia Research Council has funded a study concerning agent and landlord perspectives on terminations. Professor Alan Morris wants to interview NSW and QLD property managers about:

Circumstances surrounding terminations you have been involved with

What the termination process was like for you

How landlords and agents/property managers can be better supported to prevent avoidable terminations

Interviews can be conducted by Zoom, phone or face to face and you will receive $50 for your time. Email alan.morris@uts.edu.au or call/text 0493 140 270 to book an appointment.

Professional Development Opportunities

NSW

What: Sales Training with Aaron Shiner

When: 20 February 9:30 am to 1:30 pm

Where: Sage Hotel Wollongong

Register: Click here

What: Sales Training with Aaron Shiner

When: 25 February 9:30 am to 1:30 pm

Where: Novotel Newcastle Beach

Register: Click here

What: Property Management Think Tank

When: 26 February 9:30 am to 1:30 pm

Where: Ballina RSL Club

Register: Click here

What: Sales Training with Aaron Shiner

When: 27 February 9:30 am to 1:30 pm

Where: Ballina RSL Club

Register: Click here

What: Property Management Training with Julie Collins

When: 4 March 9:30 am to 1:30 pm

Where: Sage Hotel Wollongong

Register: Click here

What: Property Management Training with Julie Collins

When: 6 March 9:30 am to 1:30 pm

Where: Club Parramatta, Sydney

Register: Click here

What: Property Management Think Tank

When: 18 March 10:00 am to 1:00 pm

Where: Fort Scratchley Function Centre, Newcastle

Register: Click here

VIC/TAS

What: Sales Kick-Start Session

When: 26 February 9:30 am to 3:00 pm

Where: Crown Melbourne

Register: Click here

What: Property Management Webinar with Michael Furlong

When: 4 March 10:00 am to 11:00 am AEDT

Where: Zoom Webinar - Online

Register: Click here

What: Business Leadership Session

When: 13 March 10:00 am to 2:00 pm

Where: Pullman Melbourne On The Park

Register: Click here

QLD

What: QLD Sales Power Up

When: 7 March 9:30 am to 4:00 pm

Where: Rydges South Bank Brisbane

Register: Click here

SA/NT

What: Sales Training with James Williams

When: 20 March 10:00 am to 3:00 pm

Where: Norwood Football Club, Adelaide

Register: Click here

WA

What: CPD Training with REIWA

When: 21 February 8:00 am to 3:30 pm

Where: REIWA Headquarters Perth

Register: Click here

Network Dashboard