Learning & Developmen

5 Victorian agencies violate rent bidding laws

👓 1.5 minute read

Consumer Affairs Victoria (CAV) is taking five real estate agencies to court next month for violating rental legislation. All five agencies failed to include a fixed price when advertising vacancies. Instead, they used a price range or phrases such as ‘contact agent’, which is considered an enticement to rent bidding.

The five agencies are:

Barry Plant Werribee

Ray White Point Cook

White Lotus Property Group, Truganina

Yousales Pty Ltd, Docklands

PRD Mildura

All five agencies were issued infringements but opted to contest the fines in court instead of paying them. In Victoria, rental bidding can result in a fine of up to $2,371 for individuals and $11,855 for companies, with a maximum penalty exceeding $59,000 per offence for companies.

New FN Style Guide: Changes to be aware of

👓 1.5 minute read

While First National moves towards a rebrand, it’s never been more important that we all pull together to improve uniformity of brand application throughout the country.

Our 2025 Style Guide simplifies branding options so we ask all offices to review your brand compliance and ask for help if you are unsure.

What’s changed?

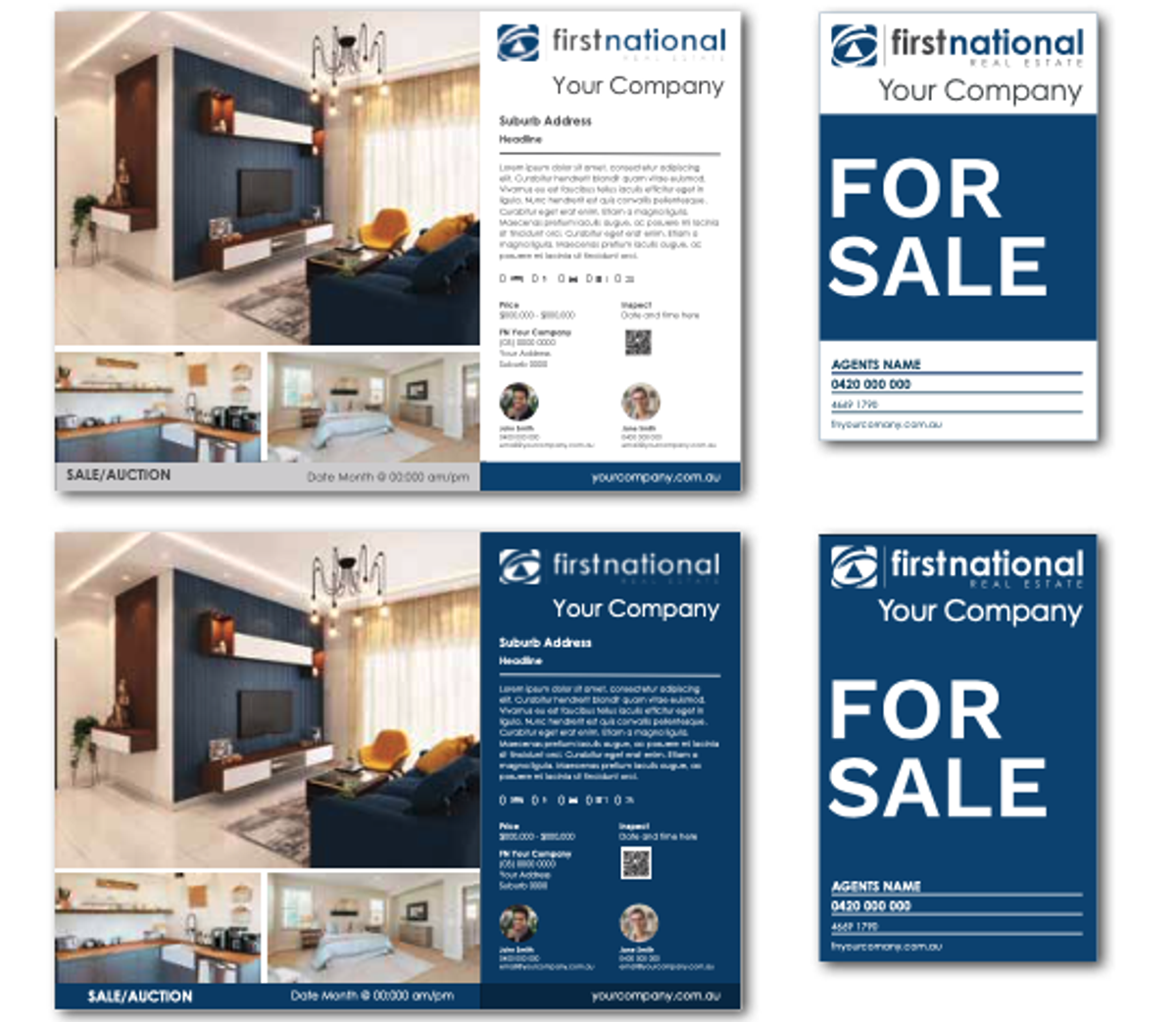

We’ve added The flexibility to use the Classic or Reverse logos interchangeably, based on what your office requires.

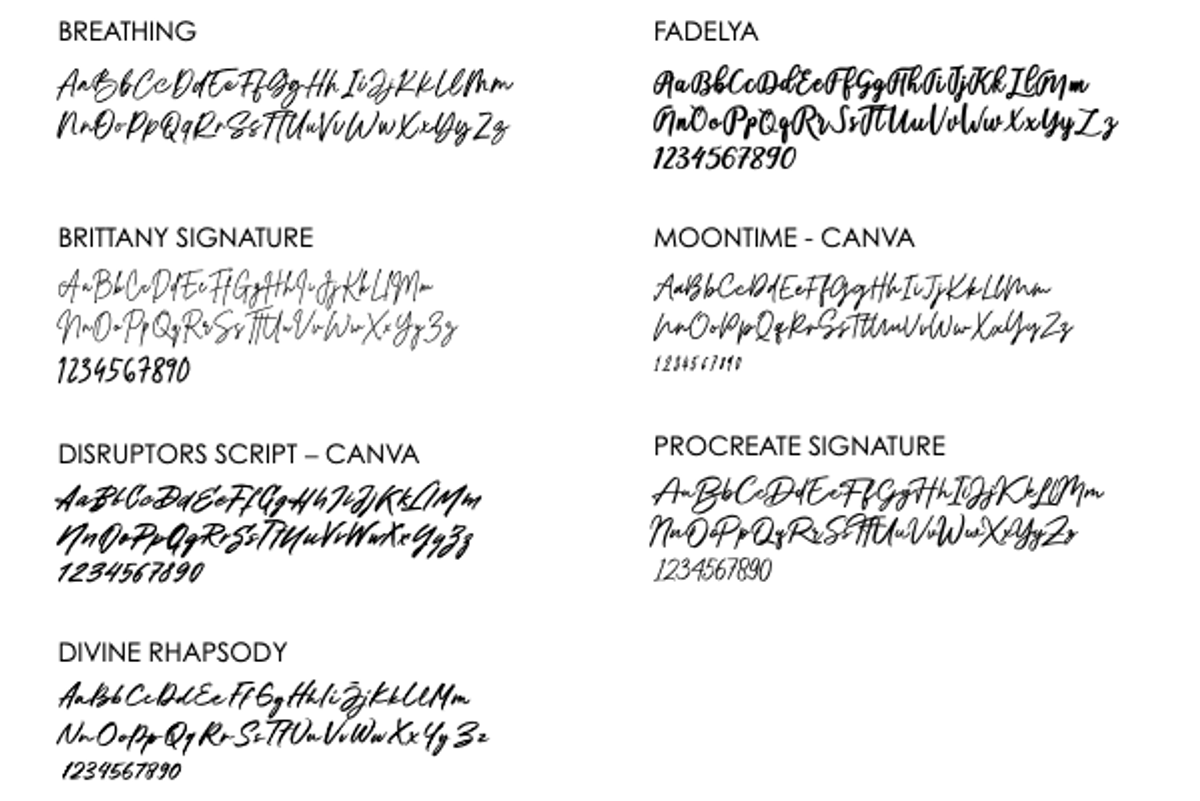

There are new fonts you can use to highlight words or phrases.

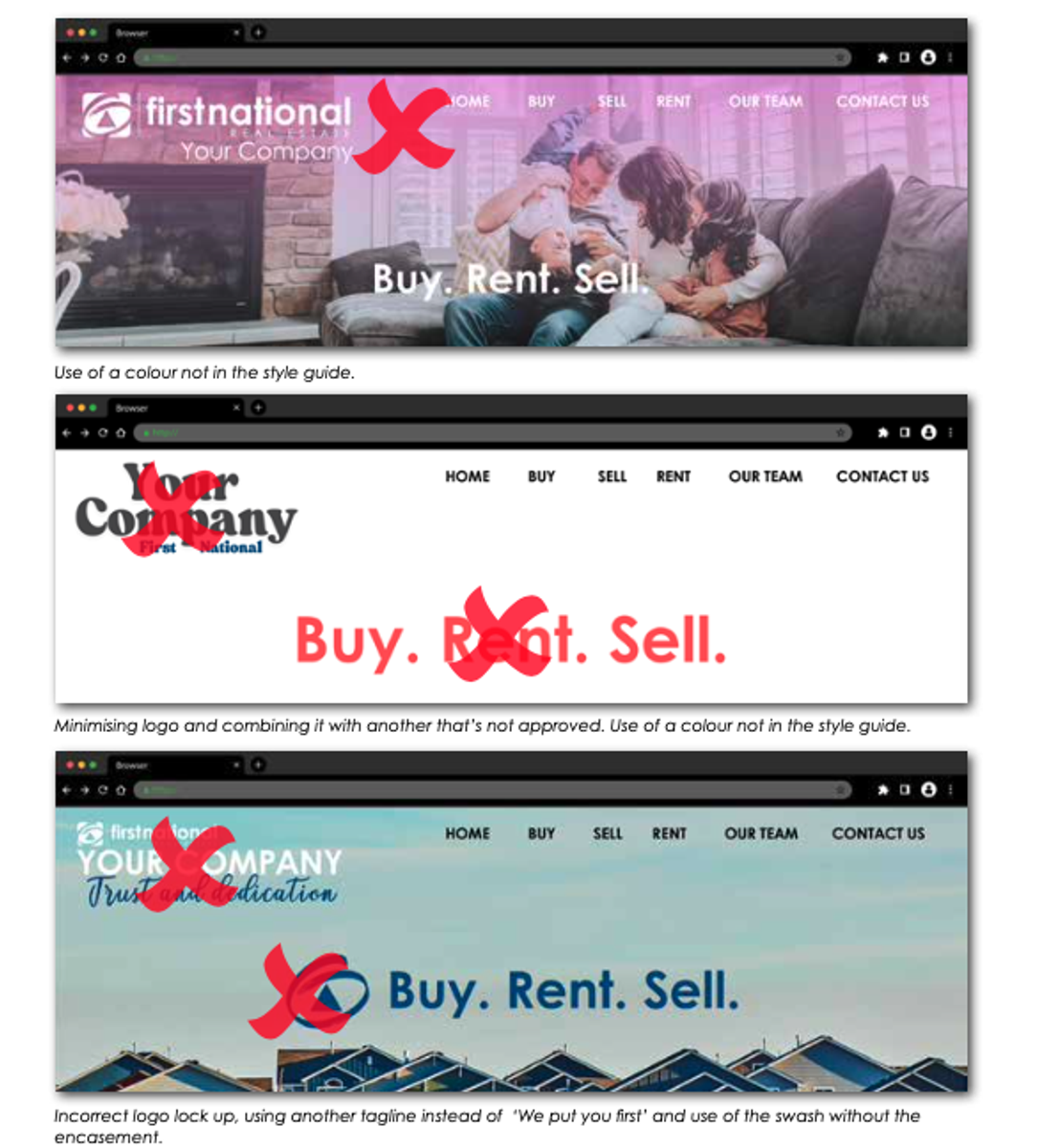

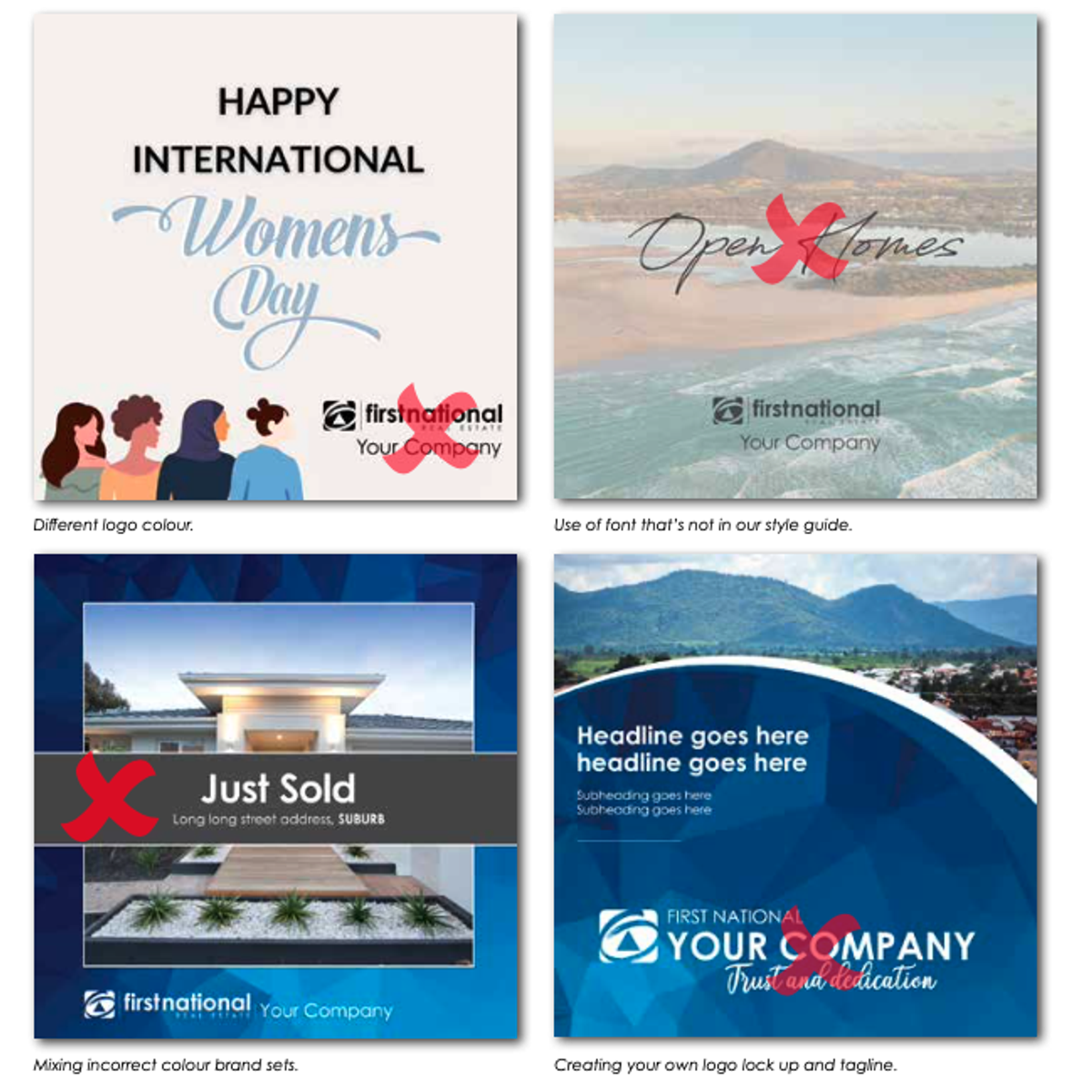

We share examples of incorrect designs.

You can now use a Swash without the round edged square on SOLD stickers (but only on SOLD stickers).

There are now design examples carrying larger, more visible logos.

Goodbye...

It’s now time to farewell Running Man, and we’ve removed brand divisions for residential and commercial – they’re now just Classic or Reverse logos.

Now restricted

If your office has already been approved to use the grey brand style, you may continue to use it. However, no new or existing classic brand offices will be approved to deploy Reverse Grey branding.

High-rise switch sees apartment prices surging 20%

👓 1.5 minute read

Apartment price growth has matched or beaten that of houses in nearly two-thirds of suburban markets over the past year as a result of surging construction costs, affordability constraints and the changing sentiment of younger homebuyers.

In many markets prices have surged by 20% or more, led by Sydney, Brisbane and Perth, reversing the pandemic trend of house prices rising faster than units.

The sharpest gains are concentrated in inner-city and coastal districts where demand for well-located high-rise stock is strongest. Analysts attribute the resurgence to surging construction costs, a limited pipeline of new apartment projects and worsening affordability that is steering younger buyers away from detached houses.

Tighter lending rules and rising migration have further intensified competition for existing units, lifting prices while rents continue to climb. Although detached dwellings led the post-pandemic recovery, the balance has now flipped, and agents are reporting a pronounced shift in enquiries towards modern complexes offering proximity to employment and amenities. With construction starts suppressed, the report warns apartment shortages may intensify, sustaining price momentum.

Separate REIA research shows two-bedroom properties and other dwellings – typically apartments and townhouses – outperformed houses in both price and rental growth over the March quarter.

‘Winner’s Curse’ assures people overpay at auction

👓 1.5 minute read

Behavioural economist Richard Holden (University of NSW) has reminded the real estate industry that the ‘winner’s curse’ is alive and well at Australian property auctions.

Because every bidder receives only partial information about a home’s true market value yet shares the same eventual resale price, the competitor with the most optimistic assumptions usually prevails – and therefore pays above the asset’s fundamentals.

Emotions, social pressure and inexpensive credit compound the effect, leading many purchasers to suffer buyer’s remorse and unexpected funding shortfalls when bank valuations arrive below contract figures. The phenomenon is well documented in auction theory: victory often signals an overestimate of value, not superior judgement.

Holden says that vendors and their agents logically favour auctions because this informational fog inflates results but cautions that habitual overpayment erodes investors’ long-run returns. For practitioners the take-outs are clear: equip bidders with transparent comparables so they set disciplined walk-away limits, and guide sellers on realistic reserves that still allow a healthy – not hazardous – premium.