Show and Tell prior to the parade for Book Week

What's been happening at OSHC

Maker of the Week - Amrita was very wise and made use of our resources to make her hat for the Book Week Parade.

Helper of the Week - Maddie wore the new OSHC fluro vest with pride.

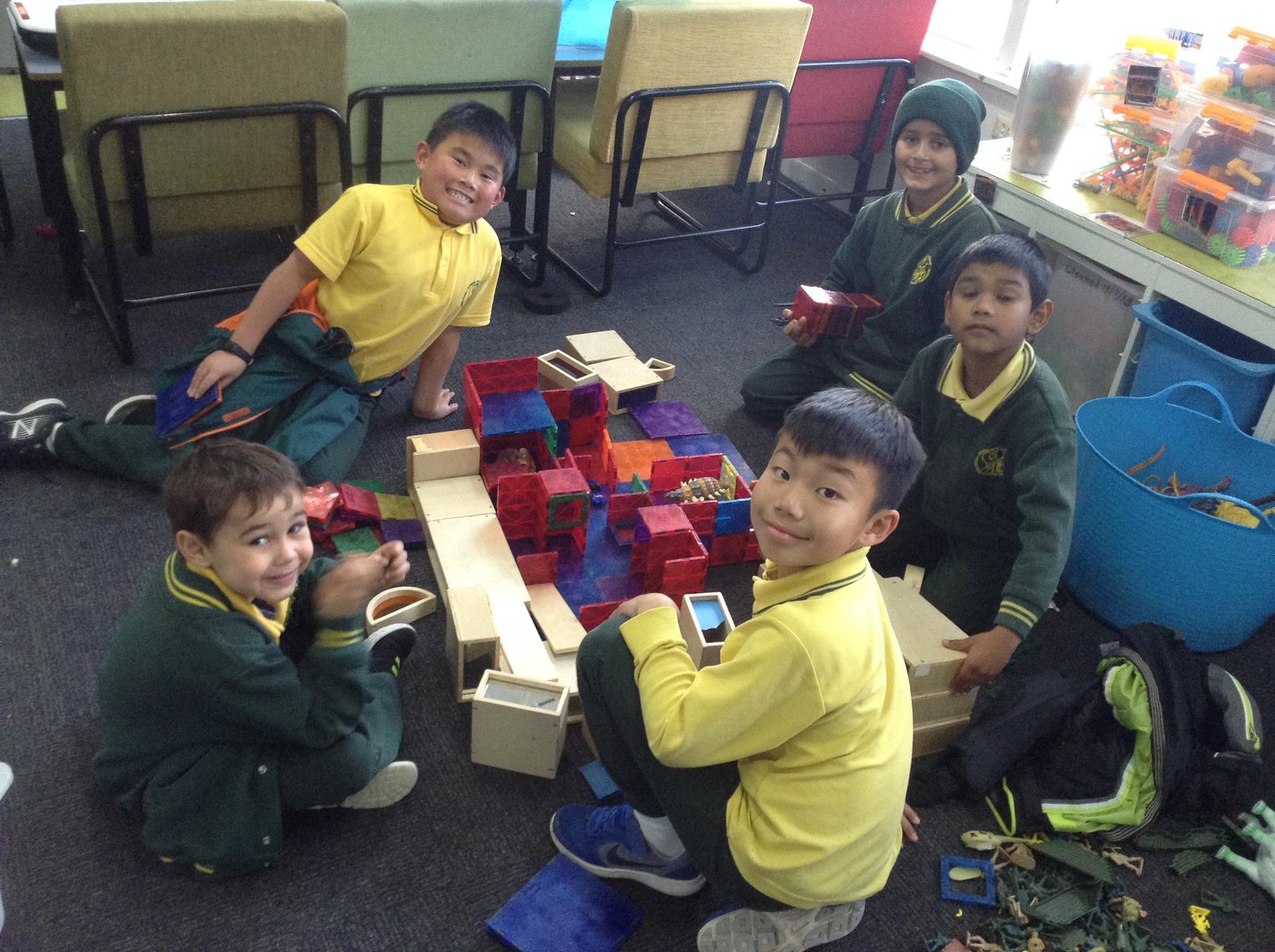

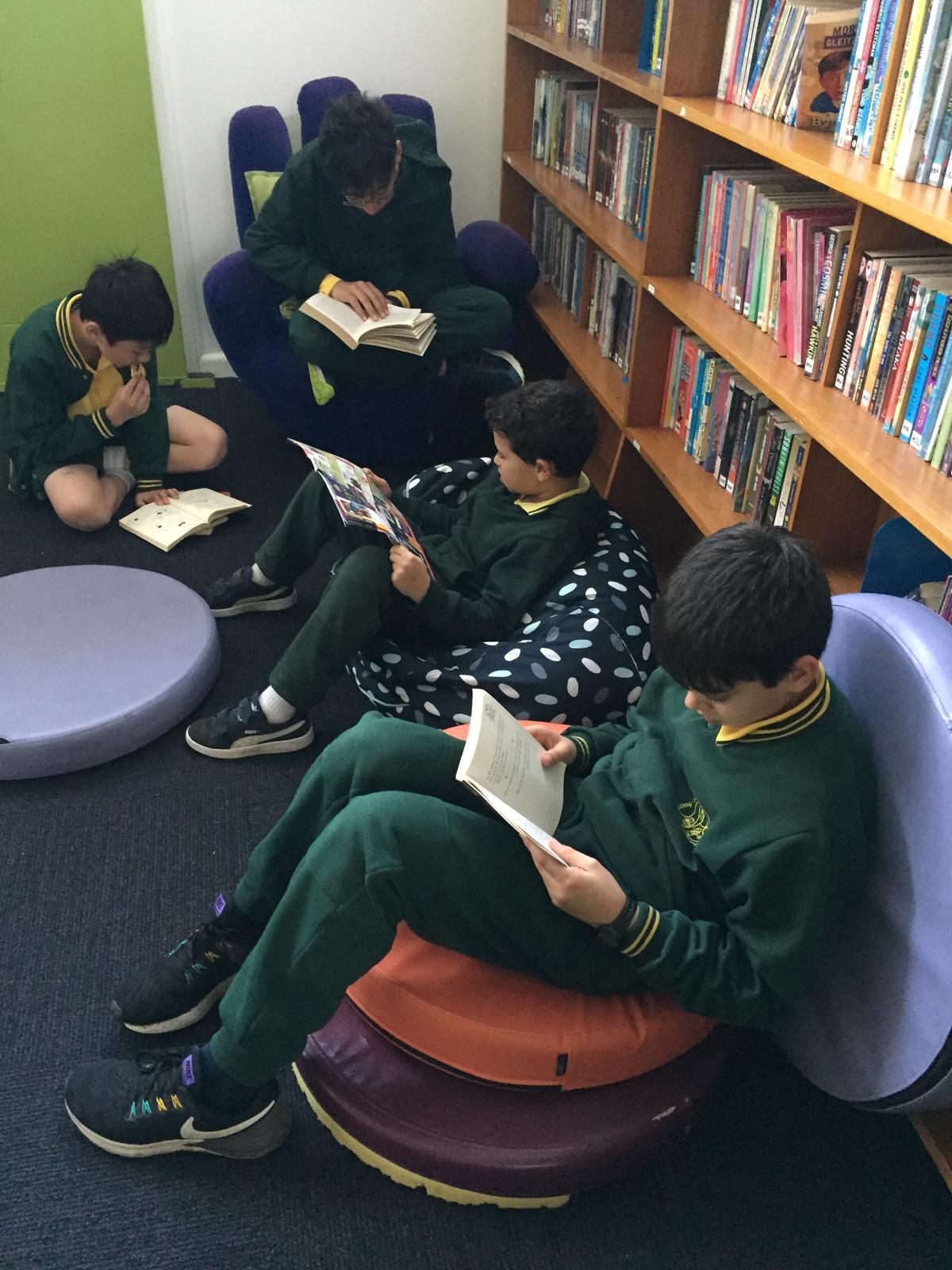

GALLERY OF EVENTS OVER THE PAST WEEK

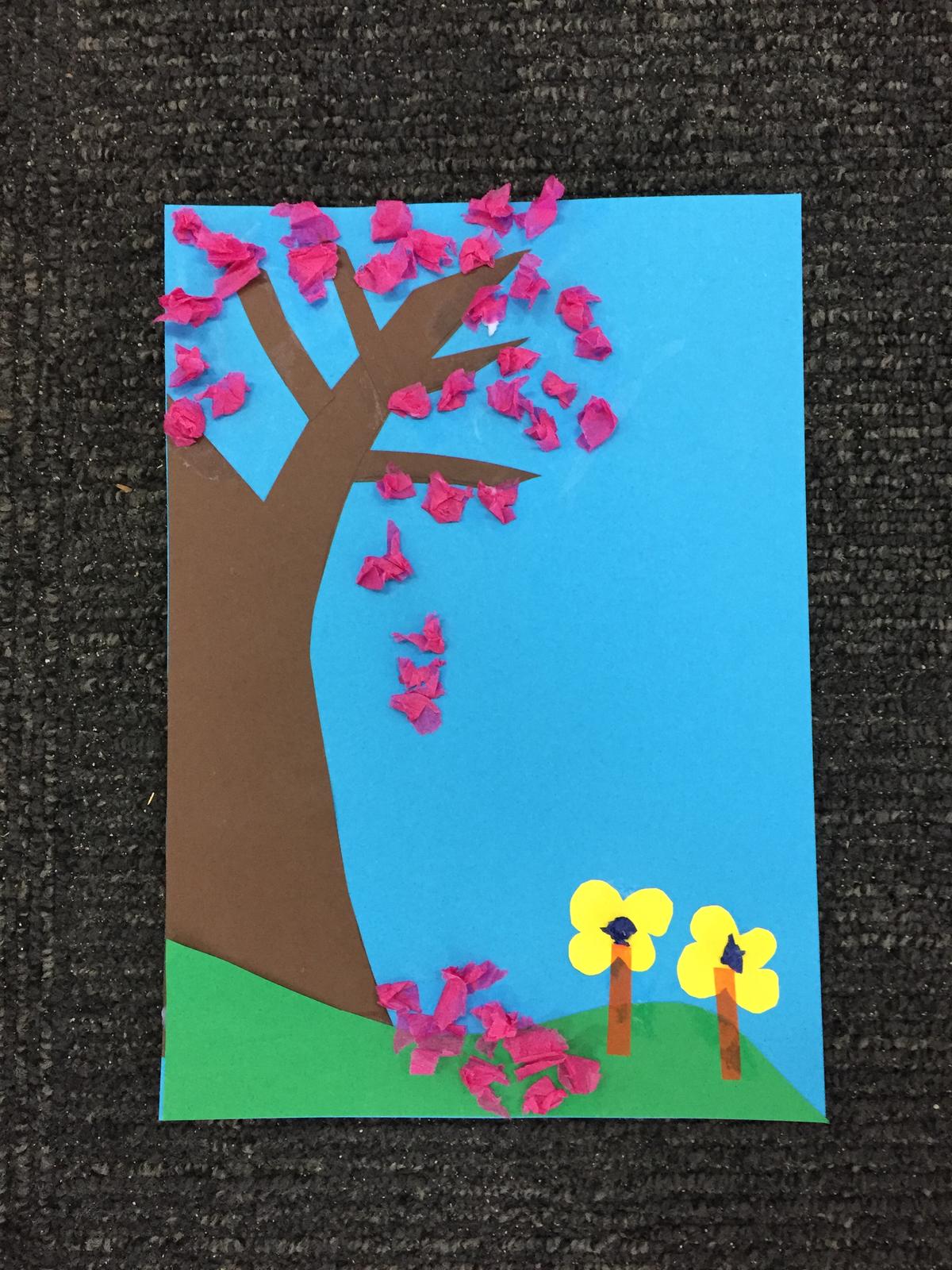

ACTIVITIES

Monday: Silly Glasses

Tuesday: Pom Pom Monsters

Wednesday: Colourful Mobiles

Thursday: Raised Salt Painting

Friday: Straw Tulips

OSHC SPECIAL BREAKFAST

Thank you to all that attended our breakfast on 28th August 2019. We acknowledge that your time is precious, especially of a morning. The children and educators really look forward to this occasion.

Starting from the 29th of August, every Thursday afternoon the program will participate in Sporting Sports for 4 consecutive weeks. If you do not wish your children to participate, please advise the OSHC educators.

Understanding the balancing of Child Care Subsidy |

The following information on Child Care Subsidy balancing has been provided to assist you in understanding the process. Centrelink is balancing families' Child Care Subsidy (CCS) entitlements. If you have any questions visit www.humanservices.gov.au/balancing. There is more information on the Centrelink website to help understand the balancing process. Throughout the year, Centrelink pays your Child Care Subsidy (CCS) based on the details you’ve given them. At the end of the financial year, they balance your CCS to make sure you received the right amount. Centrelink is balancing CCS for the 2018–19 financial year. Your CCS won’t be balanced straightaway. It can take some time. Here’s how Centrelink gets to your outcome.

1. You confirm your income You need to confirm your family’s income for the 2018–19 financial year before Centrelink can balance your CCS. You and your partner do this by lodging your tax returns with the Australian Taxation Office. If you don’t need to lodge a tax return, you need to tell Centrelink by doing an ‘Advise non-lodgement’ with them. You can do that either in your:

2. Centrelink works out your CCS entitlement Once you’ve confirmed your family income, Centrelink will work out how much subsidy you were entitled to for the financial year. They compare that amount to how much you were paid throughout the year. Centrelink then makes any necessary adjustments. This includes adding CCS withheld throughout the year. Centrelink withholds 5% of your weekly CCS during the year as a default. If you were paid too much CCS at any time during the year, Centrelink will also factor that in. This may happen if you had a change in your family’s circumstances or if your family income estimate was lower than your actual income.

3. Centrelink tells you your outcome Once Centrelink has considered all of these factors, they send you a letter with your outcome. The letter will outline how they’ve worked out your outcome.

There are three possible outcomes:

|