Industry and network

Solid start to spring selling season

Despite an early lift in stock volumes, the first weekend of spring heralded a strong start to final selling quarter of the year.

Over 2,000 homes went to auction for the fourth consecutive week, and preliminary clearance rates climbed from 70.2% to 71.7%.

- Melbourne led the auction market with 932 homes achieving 71.1%

- Sydney achieved a clearance rate of 73.2% with 774 auctions

- Brisbane achieved a clearance rate of 80% on 152 auctions

- Adelaide achieved a clearance rate of 84.7% on 59 auctions

CoreLogic did not report auction clearance rates for the 13 auctions in Perth or the three in Tasmania. Clearance rates have softened marginally each week since, but against the background of higher volumes have performed well.

Stay ahead with PMC24 - Empower, Believe, Achieve!

The annual Property Management Conference is fast approaching, presenting an unparalleled opportunity to reconnect with colleagues and forge new connections in a social setting.

Join leading industry trainers to:

- Refresh and enhance your skills

- Develop a better understanding of cultural differences to achieve better outcomes in your role

- Master the art of reading the room and de-escalating situations

- Develop strategies to handle abrupt customers with ease

- Establish boundaries that minimise challenges and conflicts

Dates & Registration

SA/NT | 15 – 16 October - REGISTER NOW

WA | 18 October - REGISTER NOW

NSW | 24 – 25 October - REGISTER NOW

QLD | 29 – 30 October - REGISTER NOW

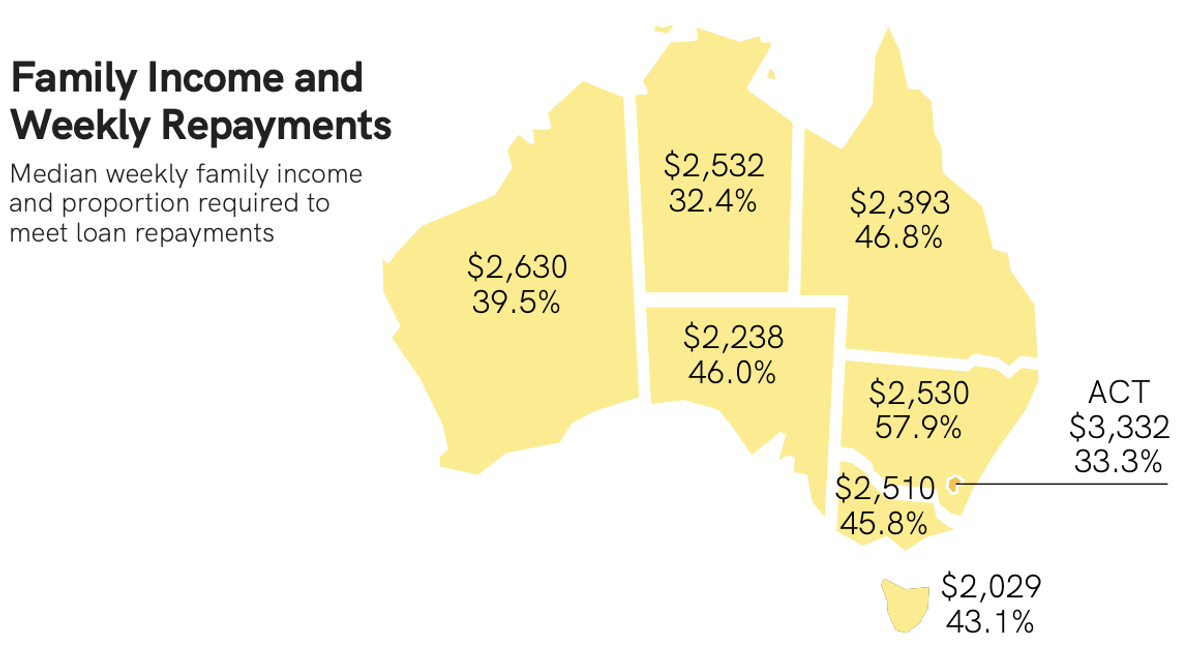

Government failing to improve affordability

Despite the positive impact of the Home Guarantee Scheme (HGS) on first home buyers, housing shortages continue. The REIA’s Housing Affordability Report shows average loan repayments now amount to 48.1% of the median family’s income, which is 1.3% more than last quarter.

- The number of first homebuyers (FHBs) has increased to 30,636 (+18.6% in the past quarter)

- There are now 7.2% more FHBs than in June 2023

- FHBs now represent 36.6% of owner occupier purchasers

- 1 in 3 FHBs are receiving support from the Home Guarantee Scheme (43,800 places taken up)

- Over 18,000 were regional buyers (with 13,000 using the Regional First Home Buyer Guarantee)

However, the Housing Australia Future Fund (HAFF) - intended to provide co-investment finance for 40,000 social and affordable homes - was supposed to announce funding in July for developers who lodged proposals in January. It did so yesterday when Housing Australia announced an initial pipeline of 185 projects that will create 13,700 social and affordable homes across the country through the first funding round.

Urban Taskforce Australia says delays in decision making from the Commonwealth are causing serious financial harm to developers and community housing providers who have teamed up to build affordable houses on sites that are already approved for construction.

Vale Graeme Rayner

It is with heavy hearts that the FN Rayner (Bacchus Marsh, Ballan, VIC) farewelled family patriarch Graeme Rayner, who had been a giant of Melbourne’s western suburbs real estate landscape since the 1980s.

Graeme was a much loved director and friend to all who worked with him, and he will be very sadly missed. His funeral service was held at Bacchus Marsh Public Hall on Tuesday 10th September. Our condolences to the Rayner family and their team.

Member fined $11,000 in Consumer Affairs Victoria inspections blitz

Further to Our Fabric 381's alert four weeks ago that a Consumer Affairs Victoria (CAV) was actively attending open inspections, CAV has fined one First National office $11,000 as a result of its crack down on underquoting and minimum standards for rental properties.

CAV officers have been requesting files and checking that authorities and the “Statement of Information” (SOI) are reflective of the price that is being publicly advertised AND that the “back-end” search range on portals is no less than the range on the authority.

Section 47C (2) of the Estate Agents Act states that in making any statement while marketing a residential property, the agent (or agent’s representative) must not state the selling price, or likely selling price of the property, at a price that is less than the estimated selling price contained in the engagement (or appointment). If the estimated selling price contained in the engagement or appointment is expressed as a range, the estimated selling price must not be less than the lower limit of that range.

It is imperative that all Victorian offices regularly audit files for any compliance issues. Do hesitate to call Business Growth Manager, James Bateman on 0413 624 329 should you have any queries.

Footy tipping competition winners

With the footy season having wrapped up, winners of First National Real Estate’s competition have been announced and prize hampers despatched. Congratulations to our sporting soothsayers!

AFL Winners

1st - Russell Pollock – FN 360 Mackay (QLD)

2nd - Kristy Surman – FN 360 Mackay (QLD)

3rd - Tony Stockdale – FN Bonnici & Associates (Beechworth, VIC)

NRL Winners

1st - Kaye Seiler – FN Pottsville (Pottsville Beach, QLD)

2nd - Matt Hutchinson – FN Coastside Shellharbour (NSW)

3rd - Ed Atkinson – First National, National Support Office (VIC)

AML and CTF Bill introduced to Parliament

As advised in Our Fabric 378, Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) reforms are on the horizon, with a focus on compliance by real estate agencies.

These reforms came one step closer to reality last week when Attorney General Hon Mark Dreyfus introduced the Anti-Money Laundering and Counter Terrorism Financing Amendment Bill 2024 to Parliament.

Under the current proposal, real estate agencies, developers, auctioneers and buyer’s agents will be required to:

- Enrol with AUSTRAC

- Develop an AML program tailored to their business

- Conduct customer due diligence

- Report suspicious transactions or activity

- Keep records

Two rounds of consultation have now taken place, with the Real Estate Institute of Australia (REIA) having lodged a submission on behalf of the industry. It argues that the New Zealand experience has cost real estate agencies between $20,000 and $60,000 to implement auditing processes and compliance officers. Further, it has expressed concern about the lack of practical policy recommendations for real estate agents.

Further information on the potential changes for real estate agencies is found here.

Download our new Calculator App

First National’s new Calculator App gives agents and customers (including first homebuyers) a set of easy-to-use tools to calculate:

- Commissions

- Stamp duty

- Settlement dates

- Loan repayment calculator

- Unit converters

- Rent vs Buy

- Property selling and buying cost

It even takes into account first homebuyer calculations concerning any stamp duty waivers applicable to their property purchase, and we’ve used this additional functionality to add this very useful page to the National Website. You might like to also link to it from your website and promote through your social media.

Link to the app from your website and promote through your social media. Embed the calculator in your website using https://www.visionabacus.net/w/ACalcList/FirstNational

Download and share the FN Calculator app with your customers today.

Time to lodge your State Awards figures

James Tostevin training at Crown

Our Victorian and Tasmanian agents loved James Tostevin’s sales training at Crown Melbourne because he’s so deeply entrenched in the day-to-day operations. From listing and selling properties to conducting appraisals and meeting with vendors, he's actively engaged in the same tasks that fill the agendas of most agents throughout their week.

‘The team really liked James’s manner, straightforwardness and of course his scripts and dialogues. He was full of energy and came across as very genuine. I can see how he has managed to generate the results he has over such a long period of time.’

Jason Brown

FN Finning (Cranbourne, VIC)

‘I found the enthusiasm James projected was very infectious, which gave me a renewed drive to achieve more. His recommendations to set a more structured day were fantastic. I would definitely recommend James's training session to everyone.’

Gary Lucas

FN Mark Gunther (Healesville, VIC)

‘Spoiling our property managers’

Lake Macquarie, the Hunter Valley and Newcastle region’s property managers caught up last week for their first PM Think Tank, coordinated by NSW Business Growth Manager, Amy Bruce

Held in the most picturesque setting, a beautiful tearoom nestled inside a lush nursery, the morning meeting was filled with laughs, learning, and treats as everyone indulged in a gourmet high tea.

‘We love spoiling our property managers; they deserve it’ says Amy.

‘Thank you to everyone who attended for your contributions. There is such a wealth of knowledge in this group of professionals. Also, a special thanks to Alexandra Haggarty for her insight and guidance, as we covered some really challenging topics.’

'I thoroughly enjoyed the session. It was a great way to interact with other PM’s in our community, and discuss topics and scenarios that may not be overly popular or don’t happen very often. Thank you again for arranging the day for us, I would love to do it again next year. 😊'

Lillianne Highfield

FN Maitland

'My team and I found it to be very valuable to our department. Unfortunately, some of our team couldn't attend this one and were extremely disappointed. We would love to participate next year and beyond, the girls are very excited this could potentially be ongoing. It is also amazing to have someone like Ali from Maitland co-hosting with her wealth of knowledge. Thank you to First National, Ali & Amy for organising the day we through enjoyed it and walked away with many topics to discuss at our next PM meeting.'

Karen Gilmore

FN Toronto