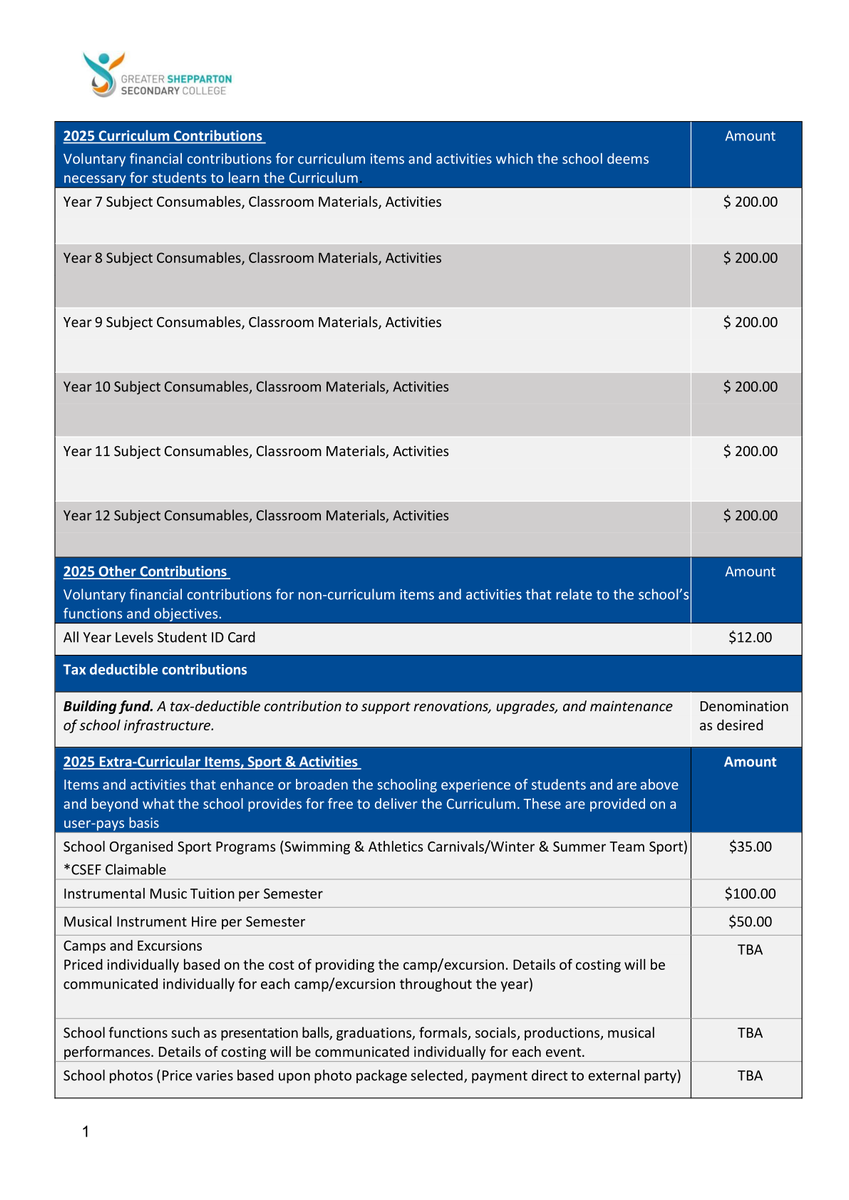

A Tax Deductible Contribution

DID YOU KNOW? - A Tax Deductible contribution option is available

Tax Deductible Gift Recipient – Building Fund Contributions

Assist GSSC to Improve Buildings into the future, and in return utilise this Contribution as a deduction in your Annual Tax Return, as we are a registered ATO Deductible Gift Recipient.

If you wish to make a Building Fund Contribution, please follow the below steps:

- Contact Finance Department on 03 5891 2000 - Option 4

- Advise the Finance Team you would like to make a Build Fund Tax Deductible Contribution of your desired amount

- Finance Team Member will discuss with you the payment options over the phone or in person

- Funds will be receipted on payment and a Tax-Deductible Receipt will be provided for you to claim in your Annual Tax Return