Alliance Partners

Five Insurances Every Real Estate Agency Needs

While Insurance certainly isn't everyone’s favourite subject, there are a number of insurances that every real estate agency should have, and some they are required to have... depending on the state or territory you are operating in.

Below is a list of the 5 important insurances the Team at Honan Insurance Group believe every agency should have. If you are unsure what you are covered for or the requirements in your state or territory, reach out for a review by the qualified brokers at Honan.

Professional Indemnity Insurance

Real estate agents provide critical advice and recommendations to clients, which can sometimes lead to claims of professional negligence. Professional Indemnity Insurance protects you and your team against claims for a Breach of Professional Duty resulting in a financial loss – such as misleading or deceptive conduct, or bodily injury relating to Property Management Services.

Professional Indemnity also provides cover for defence costs associated with investigating and resolving claims, defamation, fidelity, and expenses related to attending inquiries.

Public Liability Insurance

Public Liability Insurance is vital for real estate agents, safeguarding them against claims made by third parties for injuries or damages related to their professional activities. Key aspects of this coverage include:

Injury Claims: Covers legal costs and compensation if a client or visitor is injured on a property the agent is showing or managing.

Property Damage: Protects against claims for damage to a third party's property caused by the agent's actions or negligence.

Legal Fees: Covers the costs of defending against claims, even if they are found to be unfounded.

Business Insurance

Business Insurance protects your agency's building and contents from damage, as well as interruption to your income in the event of an Insurable Event. Coverage can include theft, money, glass, electronic equipment, general property, business interruption as well as public and products liability. If you hold your clients' property, this can also be included as coverage for items in your care, custody, and control.

Cyber Insurance

The real estate sector has recently been identified as high risk by the ACSC due to increased hacking activity, particularly in social engineering and funds transfer fraud, this is due to the regularity of high value funds transferred, as well as the large quantity of Personally Identifiable Information stored. Given this heightened exposure, ensuring adequate Cyber Insurance is more critical than ever. We have partnered with leading Cyber Liability Insurance specialists with extensive real estate experience to develop an industry-specific policy.

Management Liability Insurance

Management Liability Insurance protects your company and its directors from financial losses related to day-to-day operations, including contracts with third-party suppliers and employment practices. This coverage can include protection for statutory liability, employment practices liability, crime coverage, and fines or penalties resulting from violations of applicable legislation – such as OHS.

By securing these essential insurances, real estate agencies can protect themselves from a variety of risks and ensure their long-term success.

To review your insurances, speak to a Honan Insurance Broker today. Click here to enquire.

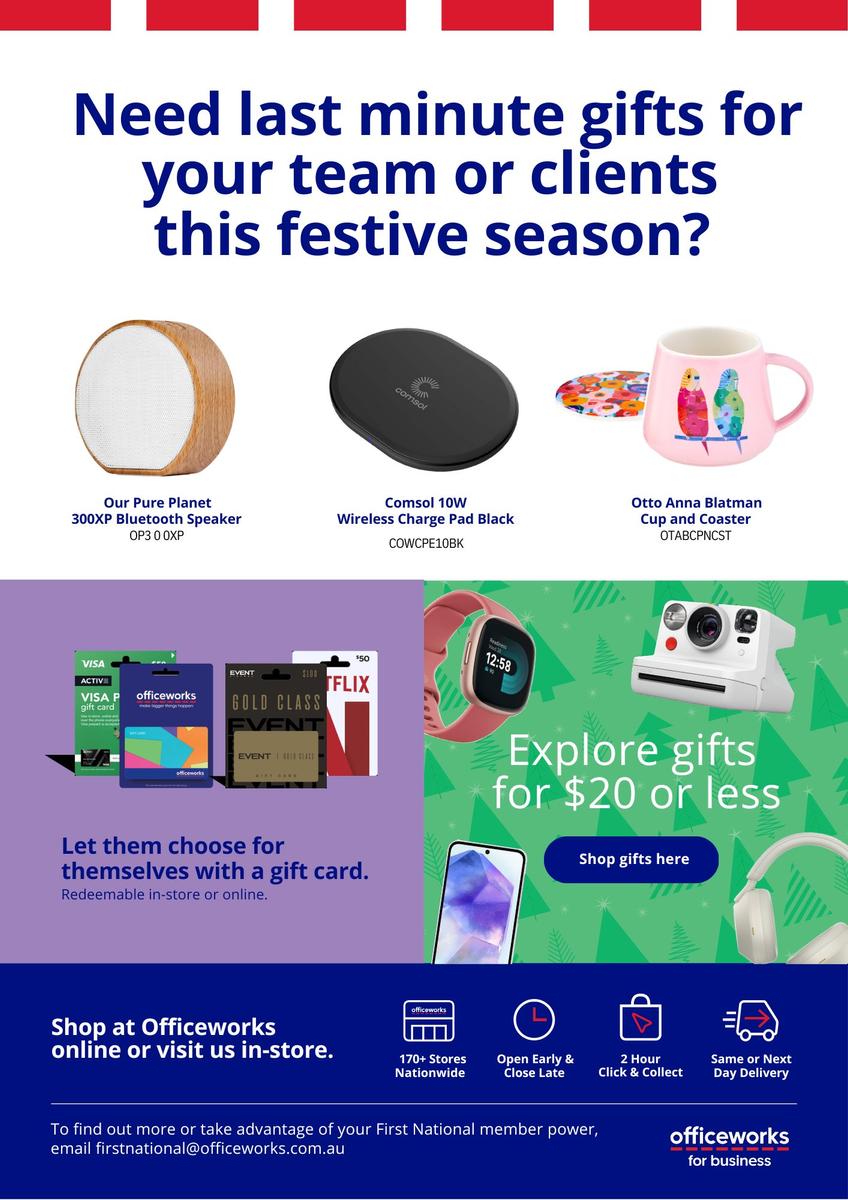

Officeworks

Fridgy, the perfect Christmas Gift for Summer